| « Back to article | Print this article |

Non-reporting of overseas income by employers may be categorised as 'abetment' under the Act.

The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (the BMA) is effective from July 15, 2015.

The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (the BMA) is effective from July 15, 2015.

The humble salaried class could also be impacted by this, and it is necessary that the employees as well as their employers identify possible non-compliance.

With the liberalised remittance schemes permitting significant investments in the overseas jurisdictions, resident employees may own assets overseas and generate foreign-sourced income.

Employees deputed abroad earn foreign-sourced income and have overseas bank accounts and other investments. Many employees are entitled to stock option benefits, allowances or bonus.

Failure to disclose overseas income and assets in the India tax return by resident and ordinarily resident employees would attract the provisions of the BMA.

Case studies

Anupama Nair, a software engineer, is deputed to Hong Kong as an onsite resource in the month of October 2015. She is a resident and ordinarily resident in India for FY2015-16 and hence her global income is taxable in India.

She is also required to report the details of her overseas assets (bank account, investments made overseas, etc) in her tax return.

Nair proposes to file her India tax return based on her Form 16, which reflects salary income in respect of Indian employment up to November 2015.

She chooses to ignore the Hong Kong-related salary income as well as income arising to her from investments made in Hong Kong.

She chooses to ignore the Hong Kong-related salary income as well as income arising to her from investments made in Hong Kong.

Nair's tax return could be picked up for scrutiny by the tax authorities. The tax officer, upon detecting non-reporting of overseas income and assets, could choose to trigger the provisions of the BMA. Let us understand the implications for Nair in this case.

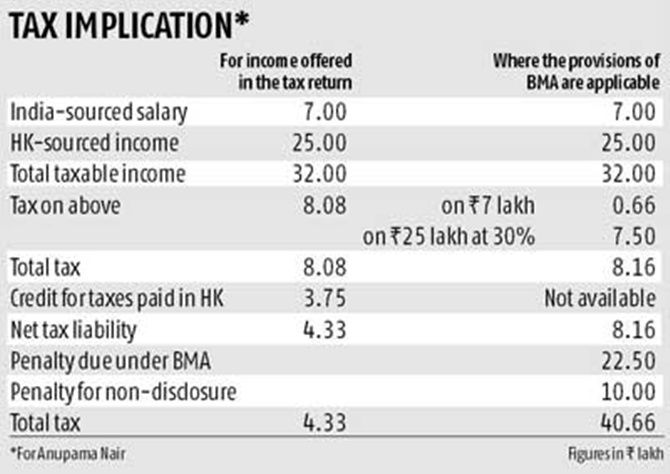

We presume that Nair had a taxable salary of Rs 7 lakh up to October 2015, and a taxable salary of Rs 25 lakh earned in Hong Kong. Nair had paid taxes at 15 per cent, or Rs 3.75 lakh on her Hong Kong-sourced salary (see Tax implication for Nair).

Let us look at another scenario. Arun Sharma has always been based in India and has been instrumental in setting up and managing the Indian subsidiary of a US entity.

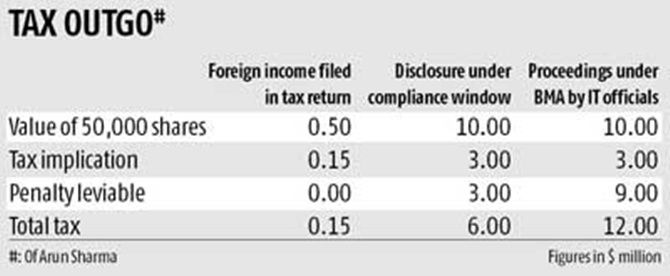

Sharma was granted 50,000 shares of the US entity after the successful setting up of the Indian entity in 2010. Sharma has been holding these shares ever since. The shares were valued at $10 each when they were allotted to him.

However, the current value of these shares would be $200 each. Sharma has not reflected these shares in his tax returns till date. How is Sharma going to be impacted under the BMA and what should he do?

Sharma was required to disclose the value of benefit received by him in the form of shares and offer the same ($0.5 million in 2010 when the shares were allotted to him) to tax.

Further, he was required to disclose the value of shares in his tax return. Sharma has an opportunity to declare the overseas assets under the one-time tax compliance window which is available under the BMA.

An analysis of possible tax implications is discussed. For simplicity, the calculations are reflected in US dollars and it is presumed that the India tax rates are at 30 per cent.

Impact on employers

Impact on employers

If the employer is responsible for the payment of overseas income of the resident employee and such income is not reported in India, it could trigger proceedings under the Act for 'abetment'.

Employers need to be aware of possible situations where the BMA could be triggered in respect of their employees:

The employees of the company are covered under the stock option scheme of the global parent. Since the benefit to the employees arise on account of the employment to the Indian entity, the responsibility of tax withholding on the stock option benefits rests with the Indian employer.

Employees are tax-equalised and the employer has the responsibility to report and remit taxes of the employee.

This situation would typically be applicable in the case of a globally mobile population, where employees receive salary and benefits in multiple jurisdictions. In the event of non-disclosure of overseas income in these situations, the employer may be held responsible for abetment.

The employer provides overseas allowances and benefits to its employees who are deputed abroad. Where such employees are residents and ordinarily residents, the employer has to consider the overseas allowances and benefits for tax withholding in India.

All of the above instances will amount to non-reporting of overseas income by the employer, which may be categorised as "abetment" under the BMA.

In many instances, employers may not include the overseas allowances and benefits for tax withholding in India since an exemption is available for expenses incurred by employees while on tour.

Employers would need to make sure that the level of documentation maintained by them is sufficient to substantiate the position adopted.