| « Back to article | Print this article |

The Indian rupee rallied for a second consecutive session on Friday to its strongest against the dollar in nearly two weeks on growing expectations the currency has been badly oversold, even as few traders expect a meaningful recovery.

The Indian rupee rallied for a second consecutive session on Friday to its strongest against the dollar in nearly two weeks on growing expectations the currency has been badly oversold, even as few traders expect a meaningful recovery.

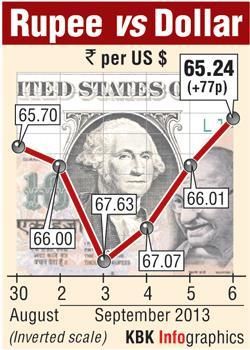

After hitting a record low of 68.85 to the dollar last week, a Reuters poll suggests the rupee will stabilise at 66 to the dollar by the end of September, while technical charts also point to a period of relative calm.

Sentiment has also improved since Reserve Bank of India Governor Raghuram Rajan unveiled a slew of proposals to support the rupee and open up markets on Wednesday, providing a breath of fresh air for investors unnerved by the country's worst economic crisis in two decades.

Still, traders are monitoring global developments.

The United States posts monthly employment data later in the day, which could help determine a timeline on when the Federal Reserve will taper its massive stimulus programme, while concerns about war in the Middle East could also sour sentiment.

Markets in India are closed on Monday for a public holiday.

"I think the rupee has already touched a near term bottom.

“We have to watch how the tension between US and Syria builds up because if war breaks, one more leg down may be seen but I still expect 68.80 to be the bottom," said Hari Chandramgethen, head of foreign exchange trading at South Indian Bank.

The rupee rose 1.2 per cent to close at 65.24/25 to the dollar, further building on a 1.6 percent rise on Thursday following the euphoria at the debut of the new central governor.

The RBI has so far been the main line of defence against the rupee with controversial measures to drain cash from markets and raise short-term interest rates.

It has also been intervening heavily, helping the rupee gain 0.7 percent this week, snapping a three-week