The rupee continued to falter, retreating from an eight-month high hit last week, to post its second consecutive weekly fall after data showed the trade deficit widened to a five-month high in March.

The rupee continued to falter, retreating from an eight-month high hit last week, to post its second consecutive weekly fall after data showed the trade deficit widened to a five-month high in March.

The data -- showing the trade deficit widening to $10.5 billion from $8.13 billion in February on the back of falling exports -- revived concerns about the current account deficit after a recent sharp narrowing.

Investors will now be closely eying the consumer inflation data due on Tuesday, as well as the start of corporate earnings results next week, for a better snapshot of the domestic economy.

Strong foreign buying by foreign investors have helped send shares to record highs this week, and boosted the rupee, although the domestic unit has faltered as some investors viewed the gains as overdone in light of the economic uncertainty.

"March trade deficit has re-widened on

the back of a jump in the oil import bill, which is likely a reflection of the hardening in global commodity prices.

"What's worrying here is that despite the gradual increase in the retail fuel prices, demand has not tapered off effectively," said Radhika Rao, an economist at DBS Bank in Singapore.

"Hence, vulnerability in this space is of concern and risks are of a reversal in the current account deficit in FY14/15 to above minus-3 percent of GDP."

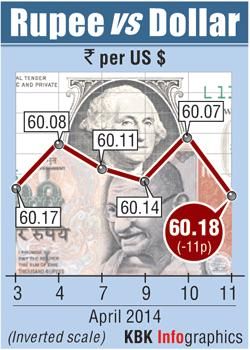

The partially convertible rupee closed at 60.1750/1850 per dollar compared with 60.07/08 on Thursday.

For the week the rupee lost 0.2 percent, continuing to retreat after hitting an eight-month high of 59.5950 on April 2.

Although foreign flows have helped sustain gains in the rupee and shares, Asia's third-largest economy, which has been struggling with the lowest growth in a decade, is seen vulnerable to any shift in capital flows.

In the offshore non-deliverable forwards, the one-month contract was at 60.65, while the three-month was at 61.45.

The rupee continued to falter, retreating from an eight-month high hit last week, to post its second consecutive weekly fall after data showed the trade deficit widened to a five-month high in March.