Nifty PSU bank index dropped nearly 2%

Benchmark indices settled the day lower after trading under pressure throughout the day as investors booked profit ahead of inflation data due today and the US Federal Reserve policy meeting later this week. Negative global sentiment due to tech sell off in US markets also dragged the markets.

Inflation in India is expected to have cooled to a new record low of 2.60% in May, according to a Reuters poll, which could add pressure on the Reserve Bank of India to cut interest rates later in the year.

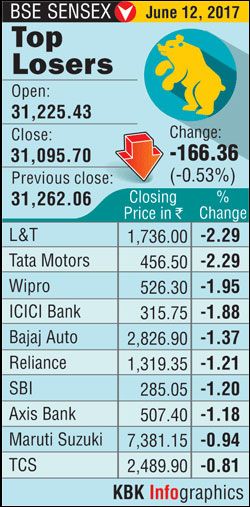

The S&P BSE Sensex was at 31,096, down 166 points, while the broader Nifty50 was at 9,616, down 52 points.

In the broader market, the S&P BSE Midcap and the S&P BSE Smallcap indices dipped 0.5% and 0.6% respectively.

In the broader market, the S&P BSE Midcap and the S&P BSE Smallcap indices dipped 0.5% and 0.6% respectively.

"Bad loans, averaging three quarters of PSU banks' net worth looked to be haunting the banking stocks as they met with Finance minister. Further, with recent GDP numbers rekindling demonetisation fears, today’s IIP release will be keenly followed if March’s 2.7% growth will be maintained or not,” said Anand James, Chief Market Strategist, Geojit Financial Services in a note.

Sectors and stocks

Nifty PSU bank index dropped nearly 2% and recorded its biggest intraday percent loss since May 29, while the Nifty Bank index settled 0.9% lower after Jaitley said Reserve Bank of India (RBI) is at an advanced stage of preparing a list of bad loans where resolution is required under the country's insolvency and bankruptcy rules.

"The RBI is at a fairly advanced stage of preparing a list of those debtors where a resolution is required through the IBC (Insolvency and Bankruptcy Code) process and you'll shortly be hearing about it," Jaitley told reporters after meeting bank chief executives.

Among public sector banks Oriental Bank of Commerce (down 4.47%), Union Bank of India (down 4.18%), Canara Bank (down 4.08%), Bank of India (down 3.84%), Bank of Baroda (down 3.54%) dragged the index. Private banks also fell after the NPA meet with Nifty private bank index down 1%.

Nifty IT index pared losses to end in green after falling over 1% at intra-day. Wipro fell over 2% after it said US president Donald Trump’s administration and his regulations could be a potential threat to its growth while Infosys (up 1.5%) and Tech Mahindra (up 2.8%) turned green at close.

Shares of Cadila Healthcare ended 1% higher after touching 52-week high of Rs 558, up 3% at intraday on the back of final approval from USFDA to market Nystatin Topical Powder.

Global markets

Europe and Asia fell on Monday on tech sell off after the worst day for Apple shares in more than a year, while the euro and its bonds rallied after a bumper weekend for pro-EU and pro-business politics in France and Italy. MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.8%.

The pan-European STOXX 600 was down a more manageable 0.6%, mildly supported by modest gains in oil prices which lifted shares in energy stocks and by the first round of parliamentary election results in France which look set to give President Emmanuel Macron a huge majority to push through his pro-business reforms.

Photograph: Danish Siddiqui/Reuters