Markets extended gains for the fourth straight session with the Nifty hitting fresh 2016 high in intra-day trade led by private lenders.

Markets extended gains for the fourth straight session with the Nifty hitting fresh 2016 high in intra-day trade led by private lenders.

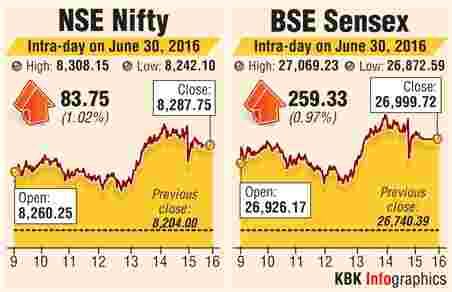

The S&P BSE Sensex ended up 259 points at 27,000. The Nifty50 ended up 84 points at 8,288, the highest closing level since October 23, 2015.

In the broader market, the BSE Midcap and Smallcap indices ended up 1%-1.3% each. Market breadth ended strong with 1608 gainers and 1003 losers.

"The progress of the monsoon has been good so far and the Brexit fears have receded. Further, foreign institutional investors which have turned buyers and positive global cues boosted sentiment," Says G Chokkalingam, Founder and MD, Equinomics Research and Advisory.

The Indian rupee firmed up by 14 paise to 67.53 against the dollar today following sustained selling of the US currency by exporters and banks, with a higher opening in the equity market backing it up.

Foreign Institutional Investors turned net buyers on Wednesday with net equity purchases of Rs 103 crore, as per provisional stock exchange data.

Meanwhile, the tax department has notified 'Foreign Tax Credit' rules effective from April 1, 2017. Foreign tax credit (FTC) will be available against tax, surcharge and cess payable under the Act, including minimum alternate tax (MAT) but not in respect of interest, fee or penalty.

STOCKS

All sectoral indices ended in the green with Power and Realty indices gaining over 2% each.

Gains were led by consumption driven stocks on hopes that higher disposable incomes post the Cabinet nod for 7th Pay Commission recommendations would boost demand.

Auto shares were among the top gainers ahead of their June sales numbers on Friday. Tata Motors, M&M, Hero MotoCorp, Maruti Suzuki and Bajaj Auto ended up 1%-2.4% each.

Private lenders were among the top gainers on expectation of demand for consumer and home loans. HDFC, Axis Bank, ICICI Bank and HDFC Bank gained 1%-3.2% each.

FMCG shares gained ground on hopes that above normal monsoon this year would boost rural volume growth. ITC and HUL ended nearly 1% higher.

Dr Reddy's Labs ended nearly 3% high.

The company bought back nearly 5.08 million equity shares for Rs 1,569.41 crore as part of a ‘share buyback’ offer launched earlier this year.

The company bought back shares at an average price of Rs 3,090.92 per share.

L&T ended nearly 1% higher.

The company's IT arm L&T Infotech is planning to raise Rs 1,240 crore through initial public offer. BHEL surged 5%.

The company's IT arm L&T Infotech is planning to raise Rs 1,240 crore through initial public offer. BHEL surged 5%.

Tata Steel ended nearly 3% higher. Reports suggest that the Brexit will not hamper sale of its UK business.

Other gainers include, Reliance Industries, NTPC, Asian Paints and ONGC among others.

Among other shares, Alembic Pharmaceuticals has surged 9% to Rs 595 on the BSE in intra-day trade after the company said the US health regulator conducted a successful inspection of its active pharmaceutical ingredient (API) facilities at Panelav, Gujarat this month.

Sagar Cements has rallied 6% to Rs 710 on the BSE after the company on Wednesday announced the complete acquisition of grinding unit owned by M/s Toshali Cements for Rs 60 crore.

Further, the initial public offer of Quess Corp, a subsidiary of Thomas Cook (India) has been oversubscribed 1.16 times.