| « Back to article | Print this article |

Benchmark indices ended near day’s high after the Cabinet on Wednesday approved the recommendations of the 7th Pay Commission.

Investors’ sentiments were further boosted due to recovery in global stocks after near term Brexit concerns eased.

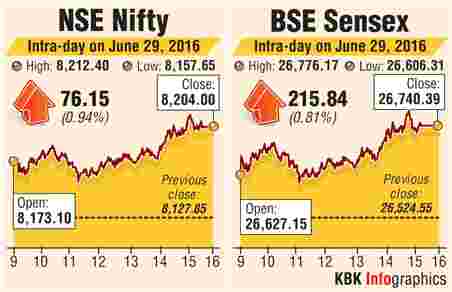

The S&P BSE Sensex rose 216 points to end at 26,740 and the Nifty50 gained 76 points to close at 8,204.

Among broader markets, BSE Midcap and Smallcap indices surged between 0.9%-1.2%, outperforming the benchmark indices.

Commenting on today's development, Motilal Oswal, CMD, Motilal Oswal Financial Services said "Just ahead of Monsoon, the 7th Pay commission will set the snowball impact in the economy.

This is a well expected positive move, this will help achieve GDP growth target quicker.

The Auto, consumer durables and FMCG sector would see much higher demand. The small concern could be that this may push inflation a bit higher”.

The Union Cabinet, led by Prime Minister Narendra Modi, on Wednesday approved the recommendations of the Seventh Pay Commission, a move which will boost consumption by putting extra disposable income in the hands of the central government’s 4.7 million employees.

The Cabinet has also approved the National Mineral Exploration Policy (NMEP) on Wednesday, which will pave the way for auction of 100 prospective mineral blocks, boosting India’s mining potential.

The Cabinet cleared the model Shops and Establishment Act that would allow cinema halls, restaurants, shops, banks and other such workplaces to be open 24X7.

Meanwhile, the revision in US Gross domestic product further lifted the mood at D-Street as it indicated an improvement in the health of the global economy.

GDP increased at a 1.1% annual rate, rather than the 0.8% pace reported last month, the Commerce Department said on Tuesday in its third GDP estimate.

Participants are now keenly watching the rollovers to the next series ahead of the expiry of June F&O series due tomorrow, auto sales volume data for June and India Manufacturing PMI for June due on Friday, respectively.

World stocks rose on speculation of monetary stimulus from the Bank of England, the European Central Bank and the Bank of Japan to counter a potential drag on the global economy from the UK's vote to leave the European Union known as Brexit.

Japanese stocks led gains in Asian markets following overnight rally on Wall Street as jitters eased after the UK's vote to leave the European Union (EU) spurred global sell-off.

The Nikkei 225 Average was currently up 1.94%. Latest data showed that Japan's retail sales fell more than expected in May in a third straight month of annual declines.

The Nikkei 225 Average was currently up 1.94%. Latest data showed that Japan's retail sales fell more than expected in May in a third straight month of annual declines.

Back home, the rupee rose 19 paise to 67.76 against the dollar at the Interbank Foreign Exchange market today on increased selling of the US currency by exporters and banks.

Top gainers from the Sensex included Hero MotoCorp, NTPC, Wipro, BHEL and GAIL, all up between 2%-4%.

Consumer-led stocks surged the most on expectations of higher consumer spend after the Cabinet today approved the recommendations of the 7th Pay Commission.

Shares of real estate companies ended higher by up to 10% on the BSE on the back of heavy volumes.

DLF, Unitech, Housing Development & Infrastructure (HDIL), Sobha, Oberoi Realty, Indiabulls Real Estate, Godrej Properties, Parsvnath Developers, Kolte Patil Developers and DB Realty rose 2%-10%.

PVR, Pidilite Industries, Grasim Industries, Muthoot Finance, Bharat Petroleum Corporation (BPCL), APL Apollo, Carborundum Universal and Tube Investments of India from the BSE500 index hit their respective lifetime highs on the Bombay Stock Exchange (BSE) in intra-day trade.

Stocks of oil exploration and production (E&P) companies edged higher on rise in global crude oil prices. Cairn India, Oil India and ONGC were up 1%-3%.

MOIL ended higher by 1.5% on the BSE after the company announced that its board approved investment proposals of Rs 461 crore in mining projects.