| « Back to article | Print this article |

Benchmark share indices lost ground for the fourth straight session to end at their lowest closing level in four months, amid a sell-off in global stocks, after further depreciation of the Chinese yuan rekindled fears of a growth slowdown in the world's second largest economy while slump in crude oil prices also dampened sentiment.

Benchmark share indices lost ground for the fourth straight session to end at their lowest closing level in four months, amid a sell-off in global stocks, after further depreciation of the Chinese yuan rekindled fears of a growth slowdown in the world's second largest economy while slump in crude oil prices also dampened sentiment.

The S&P BSE Sensex plunged 555 points to end at 24,852 after hitting a 52-week low of 24,825.70 intra-day and the Nifty50 lost 173 points to close at 7,568.

Meanwhile, the broader markets underperformed the benchmarks with BSE Midcap and Smallcap indices slumping between 2.5%-3% each.

"After the shake off given by China in terms of 3rd Currency Devaluation in a span of 5 odd months, there was sheer disappointment across the global markets. Almost all of Nifty 50 stocks closed in the negative today, a very rare reading.

"It indicates that this market may need a lot of time to recover. So far the indices are down almost 5% YTD, and the year has just begun," Said Kunal Bothra, Head-Advisory, LKP Securities.

"Nifty is very close to breaking its previous swing lows which I believe could be a formality given the fear index spiking up.

"The next supports for Nifty would then arise near the 7,380 mark and approx 24150 in Sensex," he added.

Chinese markets have put the newly-introduced circuit filter system to test for the second time in four days.

The main reason as to why global markets track China is because of the fluctuations in the Chinese currency.

On Wednesday The People’s Bank of China set the yuan’s daily reference rate at the lowest level since April 2011 which comes as a move after the manufacturing sector failed to show any signs of picking up. Panic selling is witnessed across the global peers. Japan’s Nikkei, Hong Kong’s Hang Seng, China’s Shanghai Composite lost between 2%-8%.

Among European peers, FTSE 100, CAC40 and DAX 100 plunged over 3% each.

OIL & RUPEE

Oil prices tumbled 4% to hit at fresh 12-year lows as a result of rising US energy stockpiles and China's weakening currency.

Indian rupee weakened against dollar to trade at 66.85 down 4 paise after the Chinese central bank, PBOC set the yuan midpoint to its weakest level since March 2011, sending Asian currencies tumbling.

SECTORS & STOCKS

All sectoral indices closed in the in the red with BSE Realty, Metal, Capital Goods indices losing over 3% each.

Auto stocks displayed a sharp decline across the bourses.

Tata Motors plunged 6% on concerns that the growth slowdown in China may impact JLR sales.

Maruti Suzuki plunged 4.5% on concerns that margins could be hurt because of appreciation of the yen.

Among its peers, Bajaj Auto, M&M and Hero MotoCorp lost over 2% each.

Another sector that was battered in today’s trade was the oil and gas sector with Cairn India, RIL and ONGC dropping between 2%-5%.

Meanwhile, metal stocks slumped as the devaluation of yuan would make exports to China, the world's largest consumer, costlier. Hindalco, Jindal Steel, SAIL and Tata Steel lost up to 6%.

Another pack which got hit today was the tyre pack with Apollo Tyres, Ceat and JK Tyres slumping between 4%-7% on fears that cheap imports from China may hurt sales.

Meanwhile, shares of State Bank of India (SBI), Axis Bank, ICICI Bank, Larsen & Toubro and Bharat Heavy Electricals Limited (BHEL) hit their respective 52-week lows on the Bombay Stock Exchange.

SBI lost 3.4%, BHEL cracked 7%, ICICI Bank slipped 1.5% and L&T lost nearly 3%.

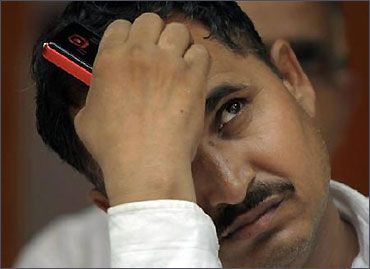

Image: A trader reacts. Photograph: Reuters