| « Back to article | Print this article |

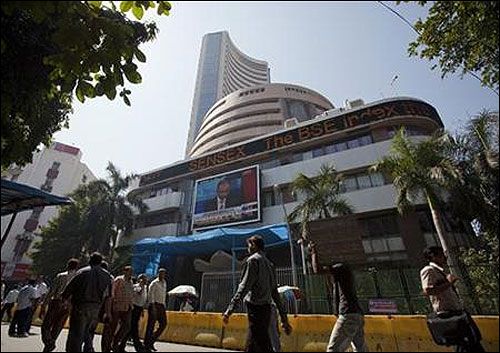

Markets ended lower on Monday amid profit taking after recent gains with index heavyweight Reliance Industries leading the decline.

Meanwhile, traders are turning cautious ahead of the April derivative contracts on Thursday and policy decisions from the Bank of Japan and US FOMC this week.

The S&P BSE Sensex ended down 159 points at 25,679 and the Nifty50 ended down 44 points at 7,855.

In the broader market, the BSE Midcap and Smallcap indices ended with marginal losses. Market breadth ended weak with 1532 losers and 1083 gainers on the BSE.

"Markets are witnessing profit taking after two weeks of stable returns supported by mixed quaterly earnings.

"We expect the US Fed and Bank of Japan to maintain their policy positions, in line with the ECB last week," said Tirthankar Patnaik, India Strategist, Mizuho Bank.

Reliance Industries ended down over 2% on profit taking after the stock appreciated nearly 10% in the last two months ahead of its fourth quarter earnings.

Meanwhile, on account of the huge Rs 1.13 lakh crore capex for the ongoing refinery and petro-chemical expansions and the proposed launch of Jio telecom, its gross debt increased to Rs 1,81,079 crore in the March quarter compared with Rs 1,78,07 crore in the December quarter.

Bharti Airtel ended up 1.7% as the company is likely to consider a buy back of equity shares in its board meeting on April 27.

The board will also consider a final dividend for 2015-16. The telecom major is due to slte its numbers this week.

Tata Motors ended down over 1% as it plans to issue non-convertible debentures to raise Rs 300 crore, and a meeting of senior executives and directors will be held on Wednesday.

TCS ended up 1.4% after the company announced the launch of Monitoring and Management Framework for Red Hat® OpenStack® Platform®".

Cairn India ended down nearly 5% after it reported its biggest quarterly loss of Rs 10,948 crore in the quarter ended March 31.

The loss was on account of impairment of Rs 11,674 crore due to lower crude prices, prevailing discount of Rajasthan crude as well as adverse long term impact of revised cess, the company said in a release.

Among others, Sasken Communications ended down 4% after it reported a consolidated net profit of Rs 174.63 crore for the March quarter on the back of exceptional income of Rs 298.12 crore.

M&M Financial Services reported a 12% rise in consolidated net profit at Rs 411.33 crore for the quarter ended March 31. The stock ended 7.5% higher.

Zensar Technologies ended over 5% lower after it reported a marginal dip in consolidated net profit at Rs 70.67 crore for the March quarter, weighed down by lower revenue from its maintenance services business.

Persistent Systems slipped over 3% after it posted a 6.24% rise in consolidated net profit to Rs.80.80 crore for the quarter ended 31 March.

Kesar Terminals & Infrastructure rallied 8% after the logistics company said that it has commenced rail terminal operations and movement of goods train from the Multimodal Composite Logistics hub of Kesar Multimodal Logistics (KMLL) -- the subsidiary of the company at Powarkheda, district Hoshangabad, Madhya Pradesh (MP).