| « Back to article | Print this article |

Thousands of retail investors are reaping the benefits of the disruption that the latest technologies have brought to the equity market.

Brokerage firms are aggressively investing in technologies such as artificial intelligence, machine learning, big data and analytics, social media, chatbots, virtual assistants and so on.

Time was when Praveen Shirole went through a raft of recommendations from share broking houses or stayed glued to business channels on television to get ideas on how to play the stock market.

Now, the Mumbai-based Shirole, who is in his early 30s and has been investing in equities for the last seven years, gets his queries answered by a chatbot, receives stock tips based on his interests, and places his trade orders through a mobile app.

“I’m receiving recommendations based on my interests. It seems someone is analysing my interest areas,” says Shriole. “For example, after this year’s Union budget, I received a report from my brokerage firm listing the announcements that were positive for my stocks and those that could negatively impact my portfolio. This shows a lot of customisation of content.”

Thousands of retail investors like Shirole are reaping the benefits of the disruption that the latest technologies have brought to the equity market. Brokerage firms are aggressively investing in technologies such as artificial intelligence, machine learning, big data and analytics, social media, chatbots, virtual assistants and so on.

And they are doing it especially to cater to tech-savvy millennials with high disposable incomes, who are flocking to the stock market to create wealth.

In FY18 alone, 3.7 million new demat accounts were opened, surpassing the previous record of 3 million accounts in 2007-2008. This is a huge business opportunity for brokerage firms and they’re hoping to cash in through their big push on technology.

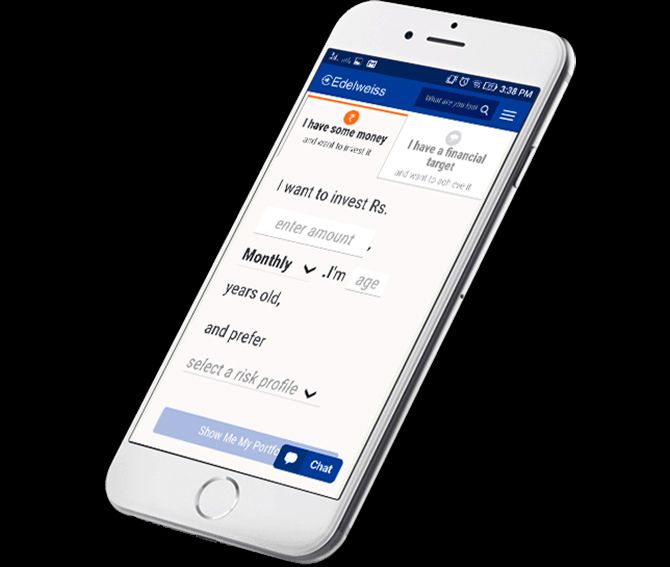

Brokerage firms like Edelweiss Securities, HDFC Securities and Karvy, among others, have introduced the concept of “conversational investing” through chatbots.

“Currently on our bot, you can invest in mutual funds, check your portfolio valuation, see stock and mutual fund recommendations and check stock prices. We are also in the process of providing live stock investments and IPO applications on the chatbot,” says Nandkishore Purohit, head, digital strategy and analytics, HDFC Securities.

“Our virtual assistant, Arya, is present on Google Assistant and Amazon Alexa, so you can invest in our recommended stocks through voice commands,” he adds.

HDFC Securities is also planning to come up with a Twitter bot to tap those who are often on the social media platform and would appreciate a way to trade through it.

Apart from bots, trading firms are using technologies like AI, Big Data and Analytics to come up with predictive analytics to understand consumer preferences and also acquire new customers.

For example, an investor who has been regularly checking the price of a particular stock on a trading platform, gets an instant alert whenever there is a sharp movement in it.

Securities firms are sending detailed analyses of the customer’s chosen stock with historical data points, comparison with peers on various financial parameters, and overall industry trends so that the customer can make smart choices.

What’s more, data analytics is being used to identify an investor’s interests from multiple touch points such as the firm’s mobile app or the customer’s browsing pattern to come up with customised and predictive content. It is now possible to get insights into investors’ future trading behaviour as well.

As Rajiv Singh, CEO of Karvy Stock Broking, says “We do predictive analytics to identify the customers who are prone to becoming dormant and enhance our interaction with them.”

Some broking firms have introduced integrated trading platforms so the customer has all the information she needs in one place.

“Our recently launched TX3 platform provides speedy trading and analytical solutions, analytical data and advanced charting. It enables the investors to spot opportunities, analyse market data and place trades all at one place,” says Rahul Jain, head, Edelweiss Personal Wealth Advisory.

Two factors are driving the investment in technology by trading firms.

First, the entry of discount brokerage firms (that charge low commission rates) like Zerodha and Upstox are changing the terms of trade. Heavy on technology, these firms have a clear focus on millennials who are comfortable with digital platforms, have high disposable incomes and are looking to the stock market to make quick profits or long-term gains.

Little wonder, then, that in just eight years, Zerodha has galloped to the No 3 position among brokerage firms. In fact, it saw a 204 per cent rise in its new client addition between FY17 and FY18.

Zerodha’s cloud-based solutions provide instant stock alerts. Hence, if you set a certain price level for a stock to execute a trade, you get an alert via the platform the moment the stock hits that price.

Second, gone are the days of information asymmetry, which would give urban investors an edge over their provincial counterpart. With increasing mobile penetration and availability of cheaper data, a huge number of investors now come from Tier-II and Tier-III cities.

Since it is not cost effective to have an offline presence in every small city, technology is playing a big role in reeling them in.

Says Shrini Viswanath, co-founder of discount brokerage firm Upstox, “We have seen more accounts being opened from Tier-III cities with the median age of investors coming down to 28-32 from the 34-40 range. Going ahead, a lot of investments will be routed through mobile apps.”

Upstox, which has a trading platform that can be supported by even 2G connections, has about 33 per cent of its investors in Tier-III and small cities. Its client base has crossed 100,000 -- a growth of over 200 per cent over 2017-18 -- and 70 per cent of its customers are in the 19 to 35 age group.

With stock trading going heavy on AI, will the human interface become irrelevant? Will market experts and “star” advisors soon become a thing of the past?

Well, we are yet to reach that stage, but the way technology is evolving, the day may not be far when the role of stock market “experts” is largely taken over by artificial intelligence.