| « Back to article | Print this article |

The Rajya Sabha on Wednesday approved the biggest tax reform since Independence.

It has been a journey of several twists and turns from 1993 to 2016.

1993: Tax expert Raja J Chelliah suggests a study of central excise duties

1993: Tax expert Raja J Chelliah suggests a study of central excise duties

Amaresh Bagchi, director, National Institute of Public Finance & Policy, tasked with this study, including a possible GST

He ultimately does not suggest GST, but only uniform state taxes

1999: A resolution adopted in the conference of chief ministers, under the chairmanship of West Bengal finance minister Asim Dasgupta on state-level VAT

2000: The empowered committee of state finance ministers set up

2004: The committee is registered under the Societies Registration Act

Asim Dasgupta made chairman of the committee

2005: On the basis of resolution, Finance Minister P Chidambaram releases a White Paper on state-level VAT

VAT introduced by most states, but states such as Uttar Pradesh, Odisha do not join in the beginning

February 2006: FM P Chidambaram proposes GST in Budget Speech. Sets April 1, 2010, as deadline

February 2007: Chidambaram says empowered committee to work with Centre to implement GST by the deadline

May 2007: Joint working group (JWG) set up with Parthasarathi Shome, then advisor to FM, and empowered committee of state finance ministers chairman Sathish Chandra as convenors

November 2007: JWG submits report

November 2009: Empowered committee submits first discussion paper on GST

December 2009: Task force appointed by 13th Finance Commission, headed by Vijay Kelkar, submit report on GST

April 2010: First deadline to introduce GST missed

March 2011: Constitution (Amendment) Bill introduced in LS for implementation of GST

May 2011: Asim Dasgupta resigns from the empowered committee of state FMs, following his defeat in polls to the West Bengal Assembly

July 2011: Bihar FM and deputy CM Sushil Modi appointed chairman of the committee

August 2011: Parliament's Standing Committee on finance submits report on the Bill

June 2013: Sushil Modi resigns from the empowered committee, following a break-up of BJP-JD (U) alliance in Bihar

July 2013: J&K FM Abdul Rahim Rather appointed chairman of the committee

May 2014: Bill lapses with dissolution of the 15th Lok Sabha

December 2014: Constitution (Amendment) Bill introduced in LS

Rather resigns as chairman of the empowered committee following his defeat in polls to J&K Assembly

March 2015: Then Kerala FM K M Mani appointed chairman of the Committee

May 2015: LS passes the Bill

May 2015: Bill tabled in the Rajya Sabha, referred to select panel

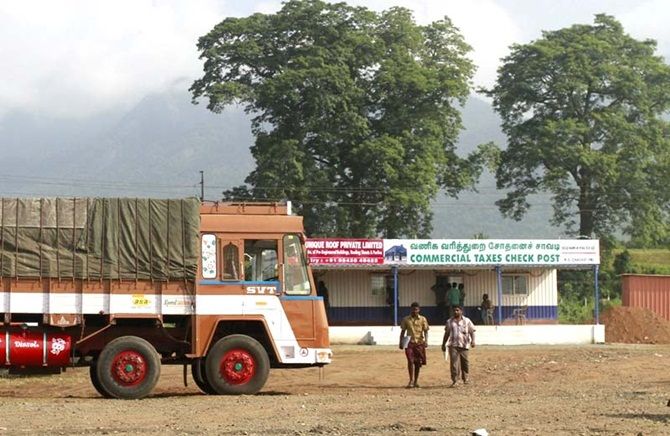

July 2015: Select panel report tabled in RS, recommends dilution of additional one per cent tax on inter-state movement of goods

Congress, AIADMK & CPI (M) submit dissent notes

Cabinet clears revised Bill

Government continues negotiations with the Congress to bring it on board

December 2015: Panel, headed by Chief Economic Advisor Arvind Subramanian, submits report on GST, recommends standard rate of 17-18%

November 2015: Mani resigns from the empowered committee following allegations of corruption in his home state of Kerala

February 2016: West Bengal FM Amit Mitra named chairman of the committee

June 2016: Draft model GST Bill floated for public comments

July 2016: Empowered committee of state FMs and Union Finance Minister Arun Jaitley meet. Agree on scrapping 1% additional duty

Cabinet clears yet another revised Constitution Amendment Bill on GST, dropping 1% tax and providing for full compensation to states for five years in case of losses under the GST regime

August 2016: Congress still has reservations on dispute resolution mechanism

Government circulates draft Bill to woo Congress & other Opposition parties

August 3, 2016: Rajya Sabha passes Bill, which will go to Presidential Reference; It will then go to the Lok Sabha