| « Back to article | Print this article |

Given the global turmoil -- US's attack on Iran, Brexit and other uncertainties -- the yellow metal may turn out to be a haven this year, suggests Sarbajeet K Sen.

With returns of over 20 per cent, gold gave the best returns in 2019 to Indian investors.

And given the global turmoil -- US's attack on Iran, Brexit and other uncertainties -- the yellow metal may turn out to be a haven even in this year.

No wonder, this asset class is finding favour with both analysts and investors.

Today, there are many options to invest in gold -- physical or digital, exchange-traded funds (ETF), fund-of-funds or sovereign gold bonds (SGB).

As physical gold does not give any interest or dividend, fans of the regular income usually prefer SGB over bullion and gold ETF.

However, SGB issuances are not available round the year.

Either you have to wait for a new issue or buy it from the secondary market.

If you are keen to take exposure to gold via SGBs, is it wise to buy from the secondary market?

SGB in a nutshell

SGBs are issued by the Reserve Bank of India on behalf of the Government of India, and each bond is expected to track the price of one gram of gold.

The bonds are issued for eight years.

However, they can be encashed or redeemed on the interest payment dates after five years from the date of issuance.

The bonds pay interest at the rate of 2.5 per cent on the initial amount of investment -- payable semi-annually.

SGBs come with a sovereign guarantee and are listed at the stock exchanges.

The bonds are tradable if held in Demat form and transferable to other eligible investors.

Is it an attractive investment?

Like any other instrument, it is the function of market performance.

SGBs will do well if gold prices remain stable.

Going by the past decade's performance (2010-2019), gold has returned 8.7 per cent compound annual growth rate, significantly less than 13.9 per cent CAGR in the previous decade (2000-2009).

Commodity experts feel there are multiple drivers which will lead to firm gold prices.

"Geo-political tensions, precarious recovery in global growth, dovish stance by major central banks, rise in negative-yielding assets, a perceptible de-dollarisation in economies like China and Russia are positives for gold. With deflation lurking around the corner, the US Federal Reserve may go for more rate cuts which are expected to sustain the momentum in gold prices. Hence, investing in SGBs can be a wise decision for a conservative investor," Alok Agarwala, head, research & advisory, Bajaj Capital, says.

If you believe gold prices will go up, then you should have exposure to the yellow metal as an asset class.

Anyway, most experts would recommend some gold from a portfolio hygiene perspective because it provides the much-needed diversification from equities and debt.

And experts seem bullish about it in the coming year as well.

"There is room for a 10 per cent increase from current levels in 2020.

With a host of uncertainties like macro-economic shifts in global markets, low global growth followed by easy monetary policy of central banks, US-China trade war, geopolitical risks and uncertainties, Brexit plaguing the global economy, gold as an asset class will be favoured by investors in 2020," Prathamesh Mallya, chief analyst, non-agri commodities and currencies, Angel Broking adds.

Buying from the secondary market

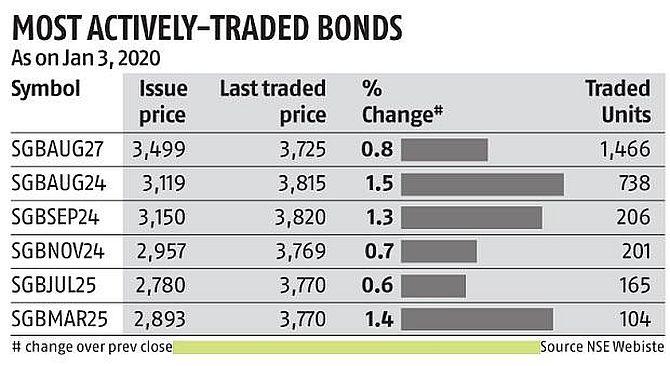

SGBs are listed both on the Bombay Stock Exchange and National Stock Exchange platforms.

Since they were issued from time to time over the past few years, there are many series of SGBs.

The problem: They are not liquid, and only a few get traded on most days.

Most series are dry for want of volumes.

SGBs are long-term instruments.

One has to be mentally prepared to hold on to them until maturity.

If you have a trading mindset, then avoid investing in SGB as you may not get an exit at fair value on the exchange.

"Although SGB's are traded in the secondary market, one has to be careful as price and liquidity risk exists in this market. There may not be enough buyers for the quantity offered, and even the price might be lower," Mallya warns.

Currently, SGB trade on the exchanges at discounts ranging from 3-10 per cent to the gold prices in the spot market.

If the situation does not change then you too may have to sell the SGB at such a discount if you decide to exit before maturity.

"Investors need to be wary of the abysmally low liquidity associated with SGBs. In fact, liquidity-induced price discount is like a double-edged sword. While attractive valuations can entice you into enter, finding a profitable exit can be a difficult proposition. What's more, if the bonds are sold before maturity, capital gains tax will apply. It is, recommended to stay invested till maturity," Agarwala said.

SGB versus gold ETF

If you are keen to buy gold for a year or two and want to trade in it, then gold ETF is a better option.

If you are eager to purchase large quantities and worried about liquidity in gold ETF units, then you can also buy a fund of funds investing in gold ETF units.

They guarantee exit at net asset value, though at slightly higher expenses.

"For investors who always want liquidity, gold ETFs are a better bet.

For those who can afford to hold till maturity, SGBs are surely a better option," Agarwala said.

| Investment features of SGB, gold ETF and physical gold | |||

| Particulars | SGB | Gold ETF | Physical gold |

| Scope for capital appreciation | Yes | Yes | Yes |

| Interest | Yes @ 2.5% p.a. | No | No |

| Sovereign guarantee | Yes | No | N/A |

| Liquidity | Tradable on exchanges; Redemption permitted after 5 years | Highly liquid | Good liquidity |

| Storage/ Insurance charges/ Quality check | No | No | Yes |

| Source: Angel Broking | |||

Sarbajeet K Sen is a journalist with Business Standard. He can be contacted at money@rediff.co.in