| « Back to article | Print this article |

'Aadhaar Pay makes cashless transactions possible even for those who do not have mobile phones. Only the merchant needs a smartphone.'

'The most important thing that has happened on account of technology is that a bank’s cost to acquire a merchant has come down significantly.'

After acquiring Grama Vidiyal Microfinance last year, IDFC Bank is looking for opportunities to strengthen its retail capabilities, says Rajiv Lall, the bank’s founder, managing director and chief executive officer.

He tells Dilasha Seth the bank was ahead of the curve by telling the market about its bad debt situation and making provisions so stressed assets do not deteriorate.

Your gross non-performing assets as a percentage of gross advances rose to 7.03 per cent in December 2016 from 3.09 per cent a year ago. How are you working to resolve the NPA problem amid increased lending efforts?

There is a rise in NPAs, but there is no deterioration in overall stressed assets.

As long as we have already provided for NPAs, there is no impairment of funds.

We were ahead of the curve when we declared to the market we had so much NPAs. The stressed asset book has not grown, but the share of NPAs has grown.

What will you do to recover dues of Rs 200 crore from Ruchi Soya? Was the high court judgment a setback?

We will keep fighting. Any time someone defaults, we are going to go after them.

The high court has given a decision. One can file an appeal. I cannot talk about the exact legal strategy, but all I can say is that we will not give up. The goal is to recover our money and we will do everything legally possible for that.

You are focusing a lot on inorganic growth, having acquired Grama Vidiyal Microfinance last year. Are more acquisitions lined up?

We are looking to accelerate our retail balance sheet. We are very focused and will carefully get something done in the next few months.

We are looking at anything that bulks up our retail capabilities — be it retail assets or retail lending.

How do you compare your Bank in a Box model vis-a-vis a traditional banking system in terms of revenue growth and cost effectiveness?

Bank in a Box is essentially about high volume but low ticket transactions.

Here, volumes have to be very large for it to make a meaningful impact. But it is very cost effective.

On the flip side, it is very difficult for me to value what revenue these customers will bring to me. If I bring down cost of acquisition and if there are regular customers, then there will be a lot more value.

How many retail customers have you added so far?

We have added 1.5 million customers in the past 18 months of our existence. We are acquiring retail customers at the rate of about 60,000-70,000 a month.

How economical is Aadhaar Pay for IDFC Bank and what does it mean for revenue growth?

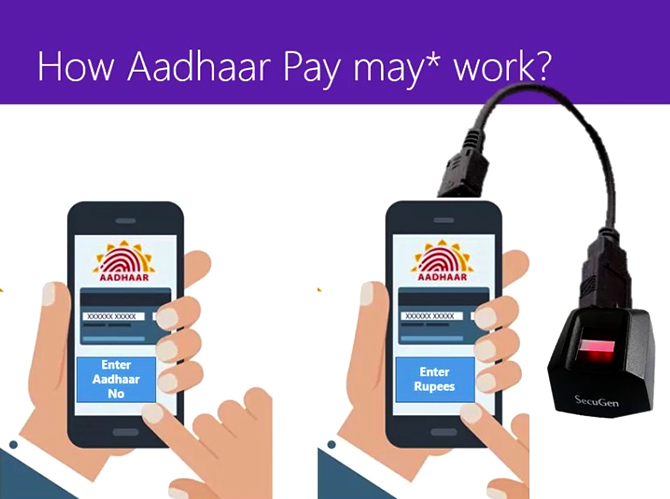

Aadhaar Pay makes cashless transactions possible even for those who do not have mobile phones. Only the merchant needs a smartphone.

As for the customers, all one needs is an Aadhaar-linked bank account. In the long term, the delivery of payments convenience to customers is a service that banks will have to provide, which is actually a cost to the bank. The opportunity will be to derive value from the large number of customers we acquire.

The most important thing that has happened on account of technology is that a bank’s cost to acquire a merchant has come down significantly. Instead of the hardware and POS (point of sale) machine, the only expense we need to make is on providing a biometric dongle to merchants to capture fingerprints.

How many merchants have you got on board so far?

So far we have 7,000 merchants on board. In the pilot phase, over 1,500 merchants have enabled digital transactions for customers of all banks using IDFC Aadhaar Pay on their smartphones.

We are targeting 50,000 to 75,000 merchants’ points to be connected to the Aadhaar Pay module in the next two years. Over the next 36 months, we are looking to get 100,000 merchants on board.

Considering that each merchant is able to acquire for me 100 savings account customers from that village in a year, it will help create a network that at least in theory is capable of acquiring 10 million savings account customers for me every year. That, I am willing to pay for.

How much does a biometric dongle cost compared to a PoS machine?

A dongle costs just about one-fifteenth of what a single PoS machine costs.

The dongle we provide to merchants used to cost us about Rs 2,500 per piece. The price has already come down to Rs 2,000 and we expect it to reduce by another 10 per cent by next year as we make bulk purchases.

How safe is this payments platform? What measures have you taken to secure it?

All devices are checked by Aadhaar and the National Payments Corporation of India network. This platform is relevant only for small-value transactions of up to Rs 10,000.

In fact, given that the focus will be mom-and-pop stores or milk booths, most transactions will be in tens of rupees.

Since there is no card or OTP involved, the threat of someone stealing your password is low. In some sense it is much more secure as all you need is a thumb print.

Not to say that there aren’t security threats. But for any technology in force today there are security risks.