| « Back to article | Print this article |

'Investors need to find out how the FMP's assets are distributed and ensure the investments are in high-quality names.'

Ashley Coutinho reports.

Illustration: Dominic Xavier/Rediff.com

New fund offerings of fixed-maturity plans (FMPs) are likely to be hit hard this quarter in the light of the current turmoil in the debt market.

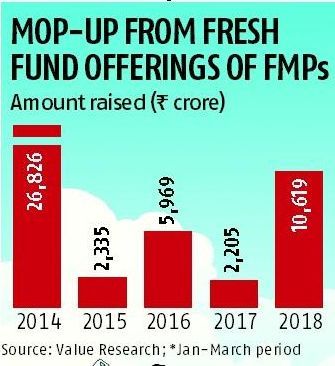

The period between January and March typically sees an uptick in the launch of FMPs -- last year mutual funds collected more than Rs 10,000 crore (Rs 100 billion) through these plans.

This year, the collections are expected to be far lower: The month-and-a-half to February 15 fetched the industry an estimated Rs 1,200 crore to Rs 1,500 crore (Rs 12 billion to Rs 15 billion) by way of FMPs.

High interest rates make FMPs attractive at this juncture.

Three-year AAA-rated papers are yielding more than 8% while AA-rated papers are fetching 8.5% to 9%.

While MFs earlier liberally invested in papers below AA, corporates are now reluctant to invest in FMPs that have below AAA-rated papers, preferring safety over returns.

While FMPs can help investors circumvent interest-rate risk, they are susceptible to credit risk.

This is especially pertinent in the current environment when a number of corporates are facing the risk of defaults and downgrades.

"Investors need to find out how the FMP's assets are distributed and ensure the investments are in high-quality names," said a debt fund manager on condition of anonymity.

Most MFs now sell FMPs with a maturity of more than three years.

This is because investors putting money in these plans before March 31 can claim indexation benefits for four years instead of three.

Capital gains from investments in FMPs for less than three years are added to your income and taxed in accordance with your individual slab rate of 10, 20 or 30 per cent applicable to you.

Investments for more than three years are treated as long-term capital gains and taxed at 20% with indexation benefit.

Indexation is a method of linking the price or value of an asset to an index of some type for the purpose of adjusting for inflation.

"Those in the lower tax bracket are unlikely to opt for FMPs as the differential in rates vis-a-vis fixed deposits are not that high. Corporates, in general, are also reducing their exposure to mutual funds," said another debt fund manager.

SBI's domestic term deposits currently fetch 6.8% for investments below Rs 1 crore (Rs 10 million), pre-tax.

Senior citizens get 7.3%.

FMPs are closed-ended debt schemes with a fixed maturity date and invest in corporate debt, government securities and money market instruments.

The securities are meant to be held to maturity; so final returns are not affected even if the underlying investments in these plans fluctuate.

Debt funds have had a poor run last year with the spike in yields and exposure of some mutual fund houses to IL&FS.

The volatility in the movement of bond yields seen last year is expected to continue.

The domestic inflation trajectory, political developments ahead of the national elections this year, the movement in global crude oil prices and global interest rates will be factors that would impact the Indian bond market, according to experts.