| « Back to article | Print this article |

The Indian economy is expected to expand by 7.5 per cent in nominal terms, and the lower nominal growth can make debt servicing difficult for the government and private borrowers, reports Abhishek Waghmare.

Illustration: Dominic Xavier/Rediff.com

The Reserve Bank of India (RBI) has reduced policy rates by 135 basis points in 2019 to support the slowing Indian economy.

However, lower rates did not lift up the economy as desired.

The Indian economy is expected to expand by 7.5 per cent in nominal terms and lower nominal growth can make debt servicing difficult for the government and private borrowers.

As the RBI reduced policy rates, yields on Treasury Bills (short-term government borrowing) dropped at a faster pace (Chart 1), indicating better transmission of policy rate into real economy rates.

However, the bulk of government borrowing is for the long term, and there yields have remained sticky.

So much that for a brief period, long-term borrowing rates went above the nominal growth rate in the economy, putting debt sustainability at risk (Chart 2).

In fact, the long-term borrowing rate for big companies (AAA-rated bonds) at 7.66 per cent is higher than the expected nominal economic growth (Chart 3) now.

This generally deters companies from borrowing and investing.

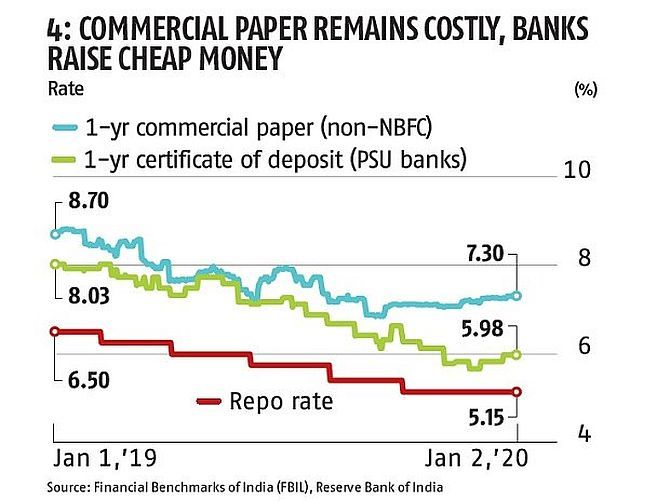

Public sector banks, on the other hand, have been able to raise money from the market at a much softer rate (Chart 4).

Short-term commercial paper, however, became costly after August.

Facilitating transmission, although the State Bank of India reduced term deposit rates to 6.1 per cent last week -- lowest in 14 years --the small savings rate for the same tenure is offering a much higher rate of return (Chart 5).

This makes reducing deposit rates difficult for banks.

In reality, not all banks have been able to absorb the rate cuts.

The gap between the average lending rate and repo rate increased from 3.47 percentage points to 4.33 percentage points in 2019, till November (Chart 6).