| « Back to article | Print this article |

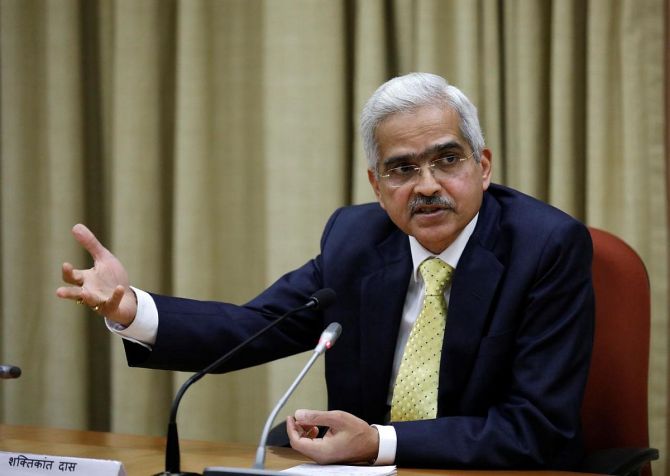

Reserve Bank Governor Shaktikanta Das on Thursday said cryptocurrencies are a "threat to macroeconomic and financial stability" and cautioned investors against punting on them, days after the Union government's move to tax the gains made from cryptocurrency trades.

In the Union Budget for 2022-23 presented in Parliament on February 1, the government proposed levying a 30 per cent tax on gains made on cryptocurrency trades by investors and the announcement was welcomed by cryptocurrency industry players, saying it legitimises their trades.

Das invoked the 17th century 'tulip mania', widely considered to be the first financial bubble, to caution investors, saying the cryptocurrencies do not even possess the value of the exotic flower.

The latest comments from the Reserve Bank of India (RBI) Governor are also a reiteration of institutional concerns on crypto assets.

"Private cryptocurrencies or whatever name you call it are a threat to our macroeconomic stability and financial stability.

"They will undermine RBI's ability to deal with issues of financial stability and macroeconomic stability," Das told reporters.

RBI has been repeatedly flagging its concerns on such instruments and had banned the banking system from aiding such trades, which was struck down by the Supreme Court in 2020.

On Thursday, Das said it is his "duty" to caution investors, and told them to keep in mind that they are investing at their own risk.

Invoking the historical 'tulip mania', Das said the investors need to keep in mind that there is no value for cryptocurrencies.

"They (investors) also need to keep in mind that the cryptocurrency has no underlying, not even a tulip," he noted.

The 'tulip mania' of the 17th century is often cited as a classic example of a financial bubble where the price of something goes up, not due to its intrinsic value but because of speculators wanting to make a profit by selling a bulb of the exotic flower.

Cryptocurrencies are said to originate or 'mined' using complex algorithms built on the blockchain platform but critics say it lacks the 'value' of legal tender whose supply is regulated.

After getting mined by running a programme, units of cryptocurrencies are traded in the secondary markets where their value has been very volatile.

The usage of such instruments as a currency to buy goods and services is very limited and so far, only Ecuador, has recognised it as legal tender but the volatile prices led to riots.

Those supporting such instruments say this should be looked at as an asset class for now but stress that they are instruments of the future.

In parallel, RBI has been making efforts to come out with a fiat digital currency.

Photograph: Danish Siddiqui/Reuters