| « Back to article | Print this article |

Even with the Rs 20,000 crore distributed among states, it will still be a fraction of what they have been demanding in financial support and clearance of pending dues.

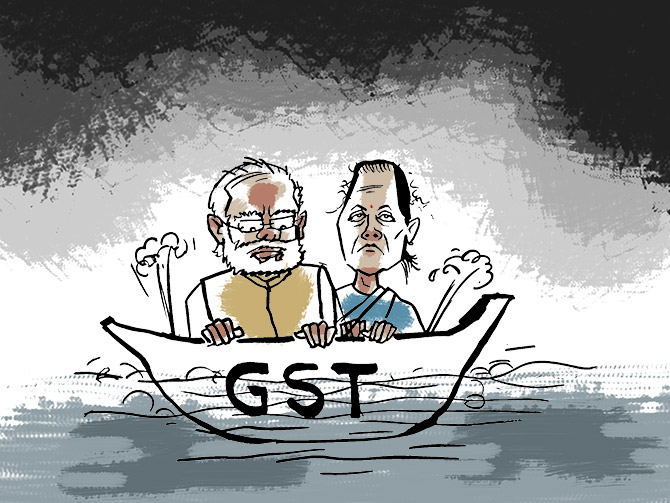

The finance ministry is set to release Rs 20,000 crore in pending Goods and Service Tax (GST) compensation to states soon, Business Standard has learnt.

This will not be from the compensation cess, but from the Consolidated Fund of India, and comes days after the Centre disbursed Rs 17,287 crore to states as devolution and disaster funds.

The finance ministry and the Prime Minister’s Office are also working on another stimulus package, which is expected to be announced soon.

There is no definitive number yet on the quantum of the package, which will again be aimed at the urban and rural poor, micro, small and medium enterprises and the sectors most affected by the coronavirus disease (COVID-19) pandemic and the subsequent 21-day nationwide lockdown.

Officials working on the stimulus package say that a lot of ever-changing factors are still under consideration.

These include active cases of COVID-19, hotspots, and the status of the lockdown after April 14.

“The revenue department has been authorised to clear Rs 20,000 crore in GST compensation dues to states,” said a top government official.

“We can only disburse compensation to states from the compensation cess fund.

"Since it is not available, approval has been given for releasing it from the Consolidated Fund,” said a second official.

Even with the Rs 20,000 crore distributed among states, it will still be a fraction of what they have been demanding in financial support and clearance of pending dues.

Central government officials say there is a resource crunch, but more will be given.

States have also been allowed to borrow 50 per cent of their total 2020-21 limit in April itself.

Maharashtra had sought a special package worth Rs 25,000 crore from the central government and asked it to release pending dues worth Rs 16,654 crore under various heads by March 31, to fight the economic crisis.

Tamil Nadu has sought a special assistance of Rs 4,000 crore and a slew of other financial support measures.

West Bengal has sought a package of Rs 25,000 crore and clearance of dues worth Rs 36,000 crore.

Additionally, all states have sought relaxation of their borrowing limits.

With only 65 per cent of compensation due for October and November at Rs 19,950 released last month, the total disbursal has been Rs 1.2 trillion as against full-year collection of just Rs 95,000 crore.

It is, in fact, Rs 3,000 crore short of the revised estimate of Rs 98,327 crore.

Compensation cess, to be released on a bi-monthly basis, has been pending for about five months.

With compensation of over Rs 60,000 crore still pending, some states are even planning to drag the Centre to the Supreme Court.

“Never in the history of India has there been such a callous attitude of the Centre towards the states.

"There is no option other than the states approaching the Supreme Court,” Kerala Finance Minister Thomas Isaac told Business Standard.

The central government was of the view that it would only release compensation out of collections through levy of cess on luxury and sin items like automobiles, tobacco, and aerated drinks.

In her Budget speech, Finance Minister Nirmala Sitharaman said it was decided to transfer to the GST Compensation Fund balances due out of collection in 2016-17 and 2018-19 in two instalments.