Chaos in Parliament threw a spanner in the government's efforts to revive the economy and kick-start reforms, notes Mukesh Butani.

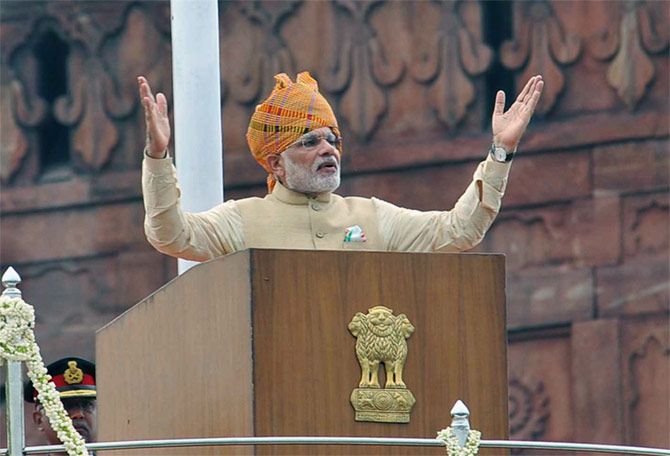

A washed out Parliament session is crescendo to the political reality the country has had to put up with, ironically on the eve of Independence Day.

After an effective winter session last year, ideological differences (on direction of reforms) have thrown a spanner into the government's endeavors to reinvigorate growth in the midst of subdued recovery.

Amongst significant legislations, the goods and services tax (GST) Bill and the land Bill were expected to cross the line.

Whilst a majority of legislative reforms are still languishing in the upper House, a non-partisan debate could have set the pace for reforms and send correct signals to world at large.

Uncertainty continues on the GST Bill, even after the Cabinet was reported to have approved a majority of amendments recommended by the Parliament select committee.

The unfinished agenda leaves the industry anxious hoping for clarity on rollout, including announcement of definitive rates of federal and state GST levies.

Judging from the development, the April 2016 target for implementation appears rather ambitious; not to forget, businesses have very little time to gear up to face an important policy change.

On the macro-economic front, though currency markets have been variable, subdued inflation and stable softening of crude oil affords extra elbowroom to the Reserve Bank of India RBI to cut bank rates.

For financial sector reforms, draft Indian Financial Code (IFC) has set the tone for futuristic regulatory reforms; the proposal to set up monetary policy committee may usher in a new era of monetary policy and rate controls, wherein the RBI may no longer carry its veto, though may still maintain de facto autonomy on rate determination.

I hope that the differences between the government and the central bank is buried and the regulator eventually yields to an improved credible structure before the draft bill finds its way to the Parliament in the winter session.

Meanwhile, the executive took a few important steps with progress on black money legislation, as the roll out of one time compliance window should help garner incremental tax revenues.

Besides, the practice of Department of Revenue to regularly issue FAQs will help clarify the law and encourage compliance. Having said that, I still believe that maintaining confidentiality (of disclosures) is key to success and the government should reiterate its commitment.

From a FDI policy standpoint, the Department of Industrial Policy & Promotion (DIPP) has pulled off a winner by announcing composite caps for FDI and permitting foreign portfolio investment upto 49 per cent under automatic route.

The move is likely to facilitate enhanced access to foreign capital especially for sector which hitherto couldn't optimally leverage permitted FDI limits due to artificial distinction between investments under portfolio and strategic categories.

Having said that, I expected greater clarity on e-commerce related FDI.

On tax policy front, the roadmap for reduction of corporate tax rate to 25 per cent (promise of 2015 Budget) is something that North block should consider in advance of the 2016 Budget.

Reduced corporate tax rate shall bring parity with effective tax collection trends. The recent trend of spike in tax collections, particularly Indirect tax is encouraging and affords an opportunity to consider rate reduction.

For a large part of this fiscal, North block was pre-occupied to resolve Minimum Alternate Tax (MAT) controversy following the prospective effect of Finance Act 2015 amendments.

Although recommendations of the government constituted Justice Shah Panel seem to suggest resolution on public disclosure of report is awaited by institutional investors.

India's concurrence to the Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information is a significant step towards embracing best practices in line with G20's initiative for curbing tax evasion.

The new system of Common Reporting Standards, once implemented, is likely to have the widest sweep and shall oblige treaty partner countries to share periodically bulk of taxpayers' information, including details of beneficial ownership.

Whilst marginal policy reforms can still be anticipated between two sessions of the Parliament, from a tax reforms standpoint, an exercise for 2016 budget should commence with all stake holder consultations.

Expectations from business are high for next year's budget, GST legislation with definitive range of tax rates; articulation of India's position on rapidly evolving "Base Erosion and Profit Shifting" work of the OECD; introducing tax arbitration in the tax treaty framework; wider set of administrative reforms to discourage unnecessary tax disputes, and an overhaul of tax dispute resolution framework should top the Budget '16 agenda.

Assisted by Sumit Singhania.

The writer is managing partner, BMR Legal. The views are personal.