| « Back to article | Print this article |

Analysts say the sell-off in risky assets will be temporary and could be a buying opportunity for long-term investors.

Analysts say the sell-off in risky assets will be temporary and could be a buying opportunity for long-term investors.

A Donald Trump victory in the US presidential election would be negative for all emerging markets, including India. It would create demand for safe-haven bets like gold and developed-world bonds.

The currency market is bracing for volatility even if Hillary Clinton secures a win as Trump has not cleared the air on whether he would accept the election results should he lose in a close finish.

"Even if Clinton wins, Trump may continue to push her and stoke uncertainty. If Trump wins, everything will fall and volatility will shoot up. This is not a time to take risks," said Jamal Mecklai, chief executive of Mecklai Financial, a currency consultancy firm.

Sensex, which has come off three per cent in the past fortnight, is likely to drop further as Trump's victory could see a Brexit-like knee-jerk reaction from investors, say analysts.

US bond prices will rally as investors would dump emerging market bets and that would impact the Indian bonds. Similarly, dollar will strengthen on increased inflow in US assets. This may lead to a sharp depreciation of the rupee and other emerging market currencies. For now, local bonds and currencies markets are stable.

Analysts, however, say that the sell-off in risky assets will be temporary and could be a buying opportunity for long-term investors.

"Prolonged high volatility in global capital markets due to adverse US election outcome could result in a sharp global equity sell-off, but in this scenario, a rate hike by the US Federal Reserve (central bank) could be ruled out anytime soon, and this would stabilise the situation," says Ravi Muthukrishnan, co-head of research at ICICI Securities.

After the domestic bond prices rally in the past few months, participants are getting nervous.

"Clinton's win will signify continuity. And therefore the market will function as normal after initial few days," said Ram Kamal Samanta, vice-president, treasury, SBI DFHI Ltd.

"However, if Trump wins, there will be a good amount of volatility in the market as risk-averseness will set in. Indian bonds will come under pressure and so will be the currency," Samanta said, adding that a Trump win could turn out well for markets in the medium term as the US presidential candidate has promised huge infrastructure spending, good for commodities, currently in a slump because of a slowdown in China.

Polls show Democrat Hillary Clinton has better prospects of winning the elections and her victory could lead to a relief rally in riskier asset classes, including emerging market bonds and currencies. Latin American markets are expected to benefit most followed by European and emerging markets. Players say these markets could gain anywhere between one and three per cent if Clinton wins.

Most of these markets already rallied on Monday after the US's Federal Bureau of Investigation stood by its July finding that no criminal charges were justified against Clinton, improving her prospects. Most Asian markets gained between 0.5 and one per cent. European markets were trading over a per cent higher on opening, while Mexican peso saw a surge.

"If the US election outcome is favourable, the US central bank may look at initiating a rate hike cycle in 2016 but this could be a long-drawn process and is unlikely to create upheavals in global capital markets given the fragile state of developed economies," says Muthukrishnan.

Before the voting starts, most Asian currencies, except South Korea's, fell. Japanese yen fell 1.16 per cent, while the Indian rupee lost 0.045 per cent to close at 66.7375.

The yield on the 10-year bond fell marginally to close at 6.835 per cent from 6.841 per cent on Friday.

Markets bloom one year after US elections

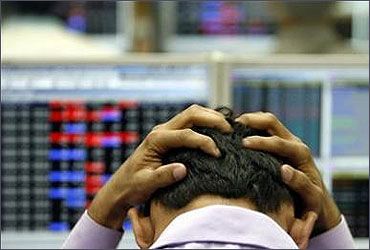

The markets are expected to be on tenterhooks in the run-up to the results of US presidential elections.

Global financial markets, which have had a volatile week, are expected to cheer Hillary Clinton’s victory. Donald Trump’s win could trigger a sell-off in risky assets.

An analysis of market performance after US election results shows stocks remain lukewarm in the short term but do quite well over a one-year period.

The average Sensex and Dow Jones returns one month after nine previous US elections results are a negative one per cent.

Average one-year returns for the Sensex have been 26 per cent and for Dow Jones nine per cent following elections results.