| « Back to article | Print this article |

'The impact of CEO transition is fairly even for stocks, with about half (53 per cent) of the events not producing any change in the relative performance of the stock.'

A change in the corner office, especially of a chief executive officer of a company, may not have much bearing on the company's stock performance, suggests a recent study by Jefferies, which analysed 72 CEO transitions over the last 5 years among large listed companies.

'The impact of CEO transition is fairly even for stocks, with about half (53 per cent) of the events not producing any change in the relative performance of the stock -- stocks outperforming leading up to the transition continued to outperform post transition as well. Ditto for underperforming stocks,' wrote Mahesh Nandurkar, managing director at Jefferies in a recent note with Abhinav Sinha.

Some of these 72 companies studied include marquee names and big conglomerates such as Larsen & Toubro Ultratech Cement, Ambuja Cement, Mahindra & Mahindra (M&M), Ashok Leyland, Fortis Healthcare, Godrej Properties, Asian paints, Tata Consumer, United Spirits, Page Industries, Bata India, Kansai Nerolac Paints, ICICI Bank, HDFC Bank, RBL and SBI Life Insurance.

However, the list of these 72 CEO changes analysed excludes the ones where promoters are seen to be in active management (DLF, Maruti, etc.) and also in most public sector undertakings (PSUs), or state-owned enterprises (SOEs), where such changes are government-directed and fairly routine, Jefferies said.

While the Covid-19 period saw CEO transitions take a back seat, Jefferies said that businesses are now dealing with changed macro/geopolitical situations.

Apart from formal CEO changes, the note said, certain companies such as Reliance Industries Limited have gradually initiated generational changes in leadership as well.

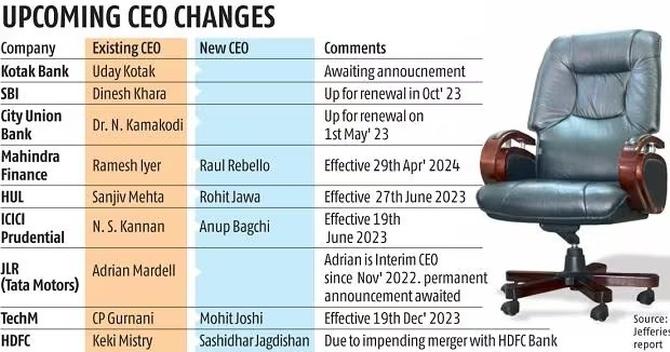

Going ahead, more CEO transitions/existing CEO term ends are likely too, in companies such as AU Small Finance Bank, Tata Consultancy Services, Hindustan Unilever and State Bank of India among others over the next 12 months.

'To analyse the stock impact, we look at its relative performance over a +/-6-month period from the 'zero date'. We believe over longer terms, multiple other factors can influence stock performance and hence are excluded. In cases where stocks reversed relative performance, 68 per cent of the changes were for good, meaning the underperforming stock became an outperform stock in six months, split equally between internal replacement versus external replacement,' Nandurkar and Sinha wrote.

To analyse the CEO transition impact on stock performance, Jefferies has defined the 'zero date' as one month prior to the actual announcement of CEO change, given that the market usually senses such changes.

Internal versus external candidate

The reach for an external candidate as a replacement CEO, Nandurkar and Sinha wrote, was higher in smaller-cap cos, with 55 per cent of them choosing to hire externally.

Meanwhile, less than 40 per cent of large-caps replaced CEOs with external hires.

'Among sectors, it is interesting to note that CEO change had a disproportionate change in Staples (5/7 saw change in relative performance) and non-bank financials (8/10), but practically none in consumer discretionary (only 1/10 saw a performance change),' the Jefferies note said.

Feature Presentation: Rajesh Alva/Rediff.com