| « Back to article | Print this article |

Valued at $5 billion, Byju’s has seen growth sky rocket in the last two years on the back of mega VC top-ups.

India’s top education platform Byju’s on Thursday announced it has achieved profitability, a first in the consumer internet start-up space.

The eight-year-old Bengaluru firm said its sales in FY19 were Rs 1,430 crore ($21 million), up 186 per cent over the last year, enough for the firm to churn out a small profit on a full-year basis.

It did not reveal the bottom line. In FY18, Byju’s had Rs 500 crore turnover and a loss of Rs 37 crore.

“The growth in revenue was fuelled by deeper penetration across India and significant growth in the number of paid subscribers,” a statement by Byju’s said.

The company presents a contrast to the other consumer internet players such as Ola, Flipkart, Swiggy and Paytm which are in the red.

Byju’s’ stronger focus on sales has allowed it to race ahead in the bottom line terms, a metrics ignored by venture capital backed companies.

Among major internet-led companies, Flipkart notched up sales of around Rs 24,717 crore, Paytm Rs 3,314 crore, Ola Rs 1,380 crore, and Swiggy Rs 468 crore in FY18.

With 2.4 million paid subscriber and an audience of 35 million (registered users), Byju’s has all but capitalised the online learning market.

Valued at $5 billion, Byju’s has seen growth sky rocket in the last two years on the back of mega VC top-ups.

Backed by investors such as the International Finance Corp, a World Bank arm, Light Speed India Partners, Byju’s last year raised $540 million from premium investors General Atlantic, Naspers, and a Canadian sovereign pension.

A favourite of the VC world. Byju’s valuation has surged over five times in about 18 months (valued at $5.4 billion in March 2019 vs $1 billion in early 2018).

Sequoia Capital, which invested in 2015, sold part of its stake, 7 per cent by one estimate, for $190 million last year, in the latest financing round.

Byju’s strength is its core offering (learning platform), and deep sales network, according to experts.

In the last one year, Byju’s has grown its sales team to 40 Indian cities, and added about 1,000 employees to a strength which stands at 3,200.

The firm sells education subscriptions to schoolgoing students, which is 90 per cent of its business, and is fast growing its test prep offering for GMAT, GRE and other entrance examinations.

Byju’s is set to launch in the US in a big way, and has recently acquired Osmo.

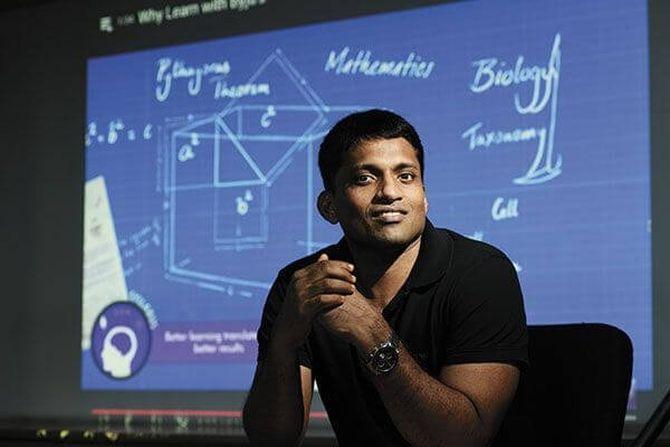

“While profitability is an important milestone for us, as a company our main focus continues to be on creating engaging learning experiences that will empower students to learn better,” founder Byju’s Ravindran said in a statement.

After all, the best part about being in this sector is the long-term positive impact you can make on the society, founder Byju’s Ravindran said in a statement.

Higher Internet speeds and an uptick in consumption the economy, has upped spending in the online education sector, comprising Unacademy, CourseEra and a wide array of up and coming start-ups in consumer and corporate learning space.

Edu-tech in India is expected to grow eight-fold to $2 billion by 2021, according to a Google and KPMG study.

Byju’s was started in 2011 by math teacher Byju Ravindran, joined by a handful of his early students.

In the early days, the company offered classroom coaching for competitive exam, before it started recording lessons online.

In 2013-14, Byju’s started distributing courses over tablets, which came bundled with the subscription.

In 2015, when 'Byju’s Learning App' was launched, it transitioned the model to delivery only though app and website.