| « Back to article | Print this article |

If the government decides to go back to the old regime where the EPF was not taxed but the NPS was, the latter will become an unattractive product.

Finance Minister Arun Jaitley seems to have put himself in a difficult position after he announced partial taxation of Employees Provident Fund (EPF). The decision affects 37 million people.

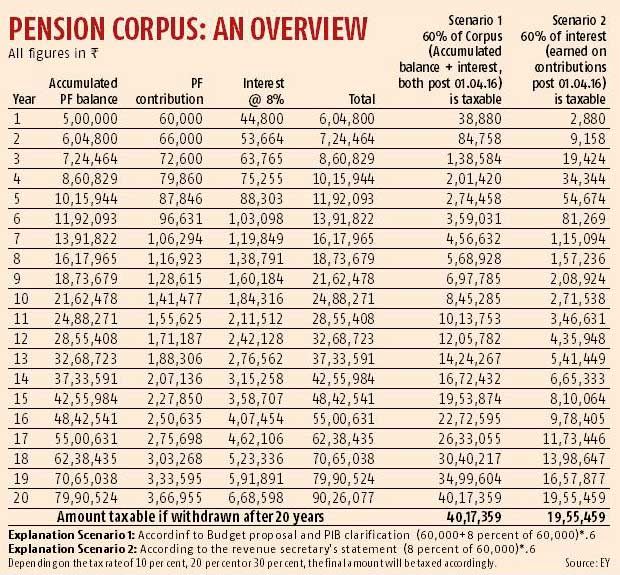

The Union Budget announced that 40 per cent of the EPF and National Pension Scheme amount would be tax-free, the rest would be taxed on withdrawal. The proposal says that only the corpus accumulating from April 1, 2016, will be taxed.

However, given the outcry from trade unions and salaried class, the government might be forced to rethink the move. A notification issued on Tuesday said the finance ministry had received several representations that would be considered by Jaitley.

"Considering the importance this matter has for employees who are creating their retirement pool through the EPF, it will be helpful to get a clear view on the taxability of such schemes," said Amarpal Chadha, tax partner, EY.

If the government decides to go back to the old regime where the EPF was not taxed but the NPS was, the latter will become an unattractive product. "The only option for the government is to make it exempt-exempt-exempt till a threshold, say Rs 20 lakh, above which the corpus can be taxed," said a tax consultant.

Another proposal is for taxing the interest income and employers' contributions up to Rs 1,50,000 because the rest of the corpus is built up from tax-paid income.

But the discrepancy between the budget announcement and the Finance Bill has confused most experts.

Said Kuldip Kumar, partner and leader of personal tax at PwC India, "Besides the statements attributed to Revenue Secretary Hansmukh Adhia that only interest income will be taxed being completely different from what was written in the memorandum of the Union Budget, even the notification issued by the PIB does not match the budget document."

Then there are other issues as well. "The Budget proposes to tax 60 per cent of the accumulated provident fund balance arising out of contributions made on or after April 01, 2016, other than for excluded employees. There is lack of clarity whether 60 per cent of the entire corpus, including principal, will be taxable," Chadha said.

"Another important question for existing employees who have accumulated a certain amount is the taxation of the interest income on their existing balance that will accrue in the future. Since even future interest income accruals will be a function of the existing amount, the question is will the government give two interest amounts, one on the amount before April 2016 and another on the new accumulation that will be taxable on withdrawal," said a tax consultant.

While the government has reiterated in the PIB notification that buying an annuity with 60 per cent corpus will result in no taxation, since the income earned from annuity will be taxed, there isn't much of a tax benefit.

"I think the government wants to nudge the relatively well-off EPF subscribers to buy annuity with their corpus. This will ensure that the entire money is not spent on personal expenditure and some income available on a regular basis their entire lifetime with nil or low tax," says Harsh Roongta, an investment advisor.