| « Back to article | Print this article |

Steel is closely linked with production activities in various sectors of the economy.

Steel is closely linked with production activities in various sectors of the economy.

Being the basic material for development of economic and social infrastructure, steel is used for producing capital goods as well as final consumption goods.

As a result, there is a direct relationship between economic growth as measured by gross domestic product and demand for steel.

The iron and steel industry in India consists of integrated steel plants based on Blast Furnace, Basic Oxygen Furnace route, main producers based on Cores, Finex or PCI Technology, mini steel plants and standalone finished steel producers i.e. re-rolling units, HR coil units, cold rolling units, GP/GC units, colour coated units and tin plates.

Besides there are units of pig iron, sponge iron, steel wire drawing, alloy and special steels and stain less steel.

Steel large players reported an inch up in net profit by 0.5% to Rs 3247 crore with the crash in margins by 263 bps to 18% and 16% increase in net sales to Rs 37832 crore.

While, steel medium and small players witnessed 72% fall in net profit to Rs 63 crore on drop in margins by 102 bps to 7% though the net sales increased by 13% to Rs 15578 crore in Q3 FY12 on y-o-y basis.

The meager performance by the steel industry is due to moderate demand from auto and construction sector coupled with the scarcity of iron ore in the Country and higher raw material costs when compared to the corresponding period of last year.

Also, the increased interest rates and forex loss had resulted the sector to witness fall in profits.

Industry Expectations:

|

Item |

Existing (2011-12) |

Proposed (2012-13) | ||

|

|

Excise Duty % |

Customs Duty % |

Excise Duty % |

Customs Duty % |

|

Articles of iron & steel | ||||

|

Castings, forgings, tubes, pipes etc. |

10 |

10 |

10 |

10 |

|

Seconds and defectives |

|

|

|

|

|

Iron & Steel |

10 |

10 |

10 |

10 |

|

Primary Forms |

|

|

|

|

|

Pig Iron |

10 |

5 |

10 |

5 |

|

Cast Iron |

10 |

5 |

10 |

5 |

|

Iron and non-alloy Steel |

|

|

|

|

|

Ingots, billets, slabs, rolled flat products, bars, rods, angles, shapes, sections, wires etc. |

10 |

5 |

10 |

10 |

|

Stain less steel and other alloy steel |

|

|

|

|

|

Ingots, billets, hot/cold rolled flat products, bars, rods, angles, shapes, sections, wires etc. |

10 |

5 |

10 |

7.5 |

|

Specified steel products including seconds and defectives from Thailand |

10 |

NIL |

10 |

NIL |

|

Defectives/CR/Coils |

|

10% |

|

10% |

|

Inputs for steel |

|

|

|

|

|

Sponge Iron / Hot Briquetted Iron (HBI) |

10 |

5 |

10 |

5 |

|

Melting Scrap of Iron or Steel(other than stainless steel) |

10 |

NIL |

10 |

NIL |

|

Scrap of stainless steel for melting |

10 |

NIL |

10 |

NIL |

|

Coking coal having mean reflectance of more than 0.60 and Swelling Index or Crucible Swelling Number of 1 and above |

1 without CENVAT Credit |

NIL |

1 without CENVAT Credit |

NIL |

|

Metallurgical coke (met coke) |

5 or 1 without CENVAT Credit |

NIL |

5 or 1 without CENVAT Credit |

NIL |

|

Coal other than coking coal |

5 or 1 without CENVAT Credit |

5 |

5 or 1 without CENVAT Credit |

NIL |

|

Nickel oxide sinters, Unwrought nickel not alloyed |

10 |

2.5 |

10 |

NIL |

|

Nickel mattes, Nickel oxide sinters from Singapore under FTA |

10 |

NIL |

10 |

NIL |

|

Ferro Nickel |

10 |

2.5 |

10 |

2.5 |

|

Ferro alloys other than Ferro nickel |

10 |

5 |

10 |

7.5 |

|

Zinc |

10 |

5 |

10 |

5 |

|

Graphite Electrodes |

10 |

7.5 |

10 |

7.5 |

|

Furnace oil |

14 |

5 |

14 |

5 |

Reduce customs duty from 5% to NIL on non-coking coal.

Presently about 20 million tonnes of sponge iron is produced through coal based route for which 34 million tonnes of non-coking coal is required.

However there is limited availability of 15-18 million tonnes from Coal India Ltd and the balance requirement is met from imports at a higher price. This has adversely affected the performance of sponge iron units.

For the quarter ended December 2011, the sponge iron sector reported aggregate net sales of Rs 5302 crore, higher by 26% on y-o-y basis.

For the quarter ended December 2011, the sponge iron sector reported aggregate net sales of Rs 5302 crore, higher by 26% on y-o-y basis.

But decline in OPM by whooping 700 bps to 22% on increased raw material costs dragged down the operating profit by 4% to Rs 1182 crore. Finally, the decline in margins and increase in non operating expenses like interest costs, depreciation costs set the net profit to decline by 26% in Q3 FY13 on y-o-y basis.

Therefore, if the custom duty for non-coking coal is reduced from 5% to NIL, the players who import coal in producing the steel or sponge iron will get benefited with the improvement in their margins on reduction in coal costs.

Exempt 4% additional duty of customs (SAD) on melting scrap of iron and steel imported by manufactures of steel.

The Induction furnace units uses inputs as iron, steel scrap and sponge iron.

It is not only making substantial contribution in the crude steel production, it is also conserving precious mineral resources of iron ore and coking coal.

In the country there are around 1100 operating Induction Melting Furnace units who are contributing in producing over 33% of total domestic crude steel production. Induction furnaces owners who uses imported melting scrap of steel pay CVD of 10% and SAD of 4%.

Their product attracts excise duty of 10%. Consequently they are unable to utilize the CENVAT credit of CVD and SAD due to lower value addition in conversion of scrap into steel, which adds to the cost. Moreover, the imported steel scrap prices are very high due to shortage of supply.

Hence, if the 4% of special additional duty is totally exempted on melting scrap of iron and steel imported by steel manufacturers, this will reduce the costs and improve the performance of the steel players who uses induction furnace in their production process.

Deemed Duty Credit on Steel Scrap for availing CENVAT Credit

The Induction Furnace industry recommends for Deemed Duty Credit on Steel Scrap for availing CENVAT Credit.

The steel melting scrap used by the induction furnace is sourced through either imports or from traders/Kabaries who collect scrap from different sources or from the non-excisable industries.

The iron steel scrap generated from non-excisable units such as SSI engineering and other SSI units making steel based products, and units located in tax free zone use steel, which is duty paid.

But there is no proof of payment of Central Excise on such scrap and hence no credit is available to furnace units who want to use this scrap and therefore the Cenvat chain breaks.

Adding to this, the indigenous steel melting scrap procured by Kabaries from small manufacturing units is available without excise documents.

As such, no excise document can be submitted to the excise authority.

Therefore, the induction furnace units are not able to get the Cenvat credit on this type of scrap.

In view of the high potential of Secondary steel sector for the overall growth of the domestic steel industry and economic development of the country, the Induction Melting Furnace units requests for allowing Deemed Duty Credit on steel scrap

Increase the basic custom duty of alloy steel from the existing 5% to at least 7.50% (if not 10%).

The alloy steel industry recommends for increasing the basic custom duty of alloy steel from 5% to 7.5%.

The growth of the alloy steel is mainly dependent on the development of the automobile and auto component industry.

Amid 2004-05 and 2007-08, the demand for alloy steel was growing at 15% a year.

This encouraged the existing alloy steel units to go for substantial expansion and several new players also entered the industry.

As a result, the production capacity increased from 6.5 million tonnes (mt) to about 11.0 mt between 2007-08 and 2010-11.

But, because of the global economic downturn in 2008-09, the alloy steel sector was severely impacted resulting into an underutilization of the capacity which is now only around 58-60% as against 80-85% for general steel.

If the import duty of alloy steel is hiked from 5% to 7.5%, the domestic alloy steel producers will enjoy better price realizations based on the higher landed costs of imports with the increased domestic production capacity utilization.

Reduce the duty on all the three forms of Nickel (Unwrought Nickel, Nickel Oxide and Ferro Nickel) from existing 2.5% to 0%.

The Alloy steel industry recommends to reduce the import duty on nickel from 2.5% to 0%. Nickel is required for producing the alloy /stain less steels is not available indigenously.

The most common stainless steels contain 8-10% nickel, 18% chromium and balance iron.

The present custom duty on all three categories of nickels viz Unwrought Nickel, Nickel Oxide and Ferro Nickel is 2.5%.

Hence, with this cut in custom duty, the margins of the domestic alloy steel producers would improve.

Ban on Export of Iron ore

The induction furnace industry urges the Government to ban the iron ore exports as it is facing a acute raw material crunch.

Iron & steel scrap is the major input material for Induction Furnace industries.

Due to shortage of indigenously available steel melting scrap because of high demand from other steel manufacturing country like China, Turkey etc.

To make up the shortage of steel melting scrap Induction Furnace industries uses DRI/Sponge iron in large proportion for making crude steel.

But, because of the high price of iron ore due to exporting this commodity the availability and price of sponge iron has been greatly affected.

Exporting of iron ore is hitting hard directly and indirectly the growth of Induction Furnace industry and other secondary steel manufacturers.

The iron ore mining ban in the three districts of Karnataka and irregular supply from Orissa and Goa are adding concerns to the steel industry though the iron ore availability improved with the directives by the Supreme court in conducting e-auctions of iron ore of 2 million tonnes per month from the stockpiles of Karnataka and permitting NMDC to mine 1 million tonne per month.

However, the normal production of iron ore is expected with the hearing from Supreme Court on lift up of ban on iron ore mines where in no significant illegality is noticed.

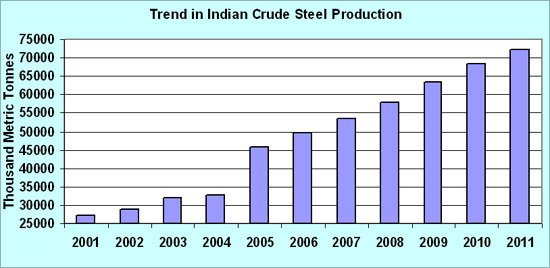

India seized the fourth place in the crude steel production followed by China, Japan, and United States in the year 2011.

India grabbed the fourth place in the crude steel production in 2011 pushing back the Russia to fifth place with the increased expansions and capacity utilizations and other facilities compared to last year.

India steel production constituted about 5% to the global steel production and grew by the same 6% in 2011 to 72.2 thousand tonnes on y-o-y basis.

In the world India and China are fast developing and China is taking a judicious policy of remain ahead of India in many areas, one of them is by way of conserving its mineral resources.

Besides china many other countries have policy of retaining mineral resource including iron ore for sustainable development of the country.

While, India is producing and exporting iron ore in large scale due to which the spot iron ore price is now reached Rs 7500 per tonne (FOB) whereas pit head cost is hardly Rs 300 per tonne.

This windfall profit of inspiring them to export around 50% of total iron ore production of the country.

This accelerating the depletion of the iron ore reserves of the country and benefiting the other competing countries of India mainly China.

The recent hike in export duty of iron ore from 20% to 30% will improve the availability of iron ore fines more than the lumps.

As, In Indian iron ore exports, iron ore fines (less quality) portion is much higher than lumps.

India is still in the process of implementing their pelletisation and beneficiation plants, which converts low-grade iron ore fines (58 Fe content) into the form of a pellet with characteristics that are appropriate for use in DRI kiln for the production of sponge iron and steel.

Therefore, the improved availability of iron ore fines with the hike in export duty may not benefit much to the Indian steel industry on the whole.

But reasonably would show impact to the steel & sponge iron mills, which are already significantly using fines in their steel process.

Increase in Basic Customs Duty of Ferro Alloys from 5% to 7.5%

Indian Ferro alloy producers association recommends the Basic Customs Duty on Ferro Alloys to be increased to 7.5% from 5%, considering the rising exports, which are keeping the capacity utilization of the domestic ferro alloy sector very low.

India has one of the major disadvantages with its power tariff 3 to 5 times higher as compared to the power tariffs available in other Ferro Alloy producing countries.

Hence, these costs disadvantages encourages the other countries to export Ferro Alloys into India at very low prices when the Duty is also at a lower level in the Country.

But , the custom duty of Ferro alloys if hiked from 5% to 7.5% , the prices of ferro alloy products increased on costly imports from other countries.

So, this will lead the alloy steel producers which uses these ferro alloy products in their steel production process will face costs pressures and impact their margins on increased raw material costs. However, we donot expect increase in customs duty on ferro alloys.

Manoj Agarwal, the Managing director of Adhunik Metaliks, which is one of the leading player in the manufacture of alloy and special steel in Eastern India, expects a rise in import duty on HR coils in the Budget 2012-13.

Apart from this, the Steel Ministry recommends the custom duty hike for steel from existing 5% to 10% in the coming Budget.

Hence the hike in import duty of steel would reduce the imports and thereby increases the domestic production capacity utilization and this can also improve the exports.

On the other side, the steel prices might still rise further on the increased landed costs of imports.

But this price increase is strictly expected to be controlled by the Government.

Analyst Expectations:

Reduction of custom duty of non-coking coal from 5% is expected (if not NIL) and exemption of 4% additional duty of customs (SAD) on melting scrap of iron and steel imported by manufactures of steel is also expected as both of the measures would increase the growth of the steel industry.

With sharp hike in export duty, an immediate ban of iron ore exports is unlikely.

Stocks to Watch:

Tata Steel, SAIL, JSW Steel, Essar Steel, JSW ISPAT

Outlook

The focus of the budget is expected to be an infrastructure development. Steel being the core sector is expected to be an indirect beneficiary of the focus of Infrastructure Development.

A greater thrust on infrastructure could facilitate acceleration in demand for longs.

Globally, the steel production and the demand had subdued on the back of Euro zone crisis and tight liquidity scenario in China.

The world crude steel production for the 64 countries reporting to the world steel association for the year 2011 recorded a 7% growth at 1.49 billion tonnes.

However, the growth in world crude steel production almost halfed from record high 15% in 2010.The world steel capacity utilization ratio continued to downfall from the peak 83.3% in Jan to reach 71.7% in Dec 2011. Further the global demand is expected to remain stable on festering Euro zone crisis.

During March 2012, the steel long prices as per NCDEX stood at Rs 36,387.5 per tonne higher by 22% Steel angles (long product) prices are at Rs 44,740 per tonne and steel CR coils prices are at Rs 50,950 per tonne.

The steel prices are at new highs on the back of scarcity of iron ore in the Country coupled with the higher melting scrap prices.

The demand in the domestic markets is expected to improve with the continued easing of monitory policy by RBI in near future.