| « Back to article | Print this article |

While discount brokers have managed to grow at a rapid pace, they have not been successful in capturing substantial market share in the above-40 age category.

Sundar Sethuraman reports.

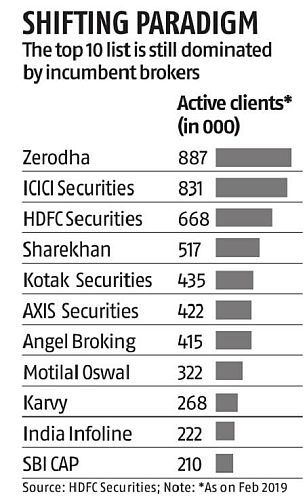

The equity broking industry is getting disrupted with the rapid rise of discount brokers such as Zerodha, says a note by HDFC Securities.

The trend is likely to continue with the growing customer base of discount brokers and the announced entry plan of PayTM Money.

In the next few years as the disruption picks up the pace, incumbents will be forced to reduce broking charges even for cash products, the note said.

Zerodha, the country's largest broker in terms of the number of clients, has cornered a 15% volume market share in just five years.

While discount brokers have managed to grow at a rapid pace, they have not been successful in capturing substantial market share in the above-40 age category, points out HDFC Securities, adding that they will 'increasingly look to target' this segment.

HDFC Securities says capturing new clients has increasingly become more difficult, constraining growth.

In such, a scenario cost competitiveness will become a key.

The note said keeping costs low would be vital for survival if discount brokers continue to grow.

Zerodha is operating on fixed operating costs of Rs 1.2 billion and total operating costs of Rs 2 billion in FY18.

In comparison, ICICI Securities had total costs of Rs 9.4 billion in FY18.

The note says discount brokers will have to invest in new apps.

Zerodha recently on-boarded Small case (index creating and investing platform), Sensibull (option strategy trading platform) and Streak (algo-creation, backtesting platform).

Additionally, Zerodha's new product plans include de-construction of ULIP and selling term insurance and direct mutual funds separately, launching investing platform for US equities, margin funding and direct retail investing in Indian government bonds, the note said.

The note says new entrants would be able to disrupt the market if the technology is correctly deployed.

'Given that companies have seen Zerodha be immensely profitable, we expect new entrants to follow suit. Platforms such as Sensibull, Streak and Smallcase enhance user experience and may prove to be attractive add on feature for a certain set of customers,' the HDFC note said.

'Traditional retail brokers are adapting and also integrating such applications on to their platforms.'