| « Back to article | Print this article |

ONGC was the top loser, shedding around 6.50 per cent, followed by M&M, Bajaj Finserv, Axis Bank, Kotak Bank, PowerGrid, HDFC Bajaj Finance and ICICI Bank.

NSE Nifty plunged 568.20 points to close at 14,529.15.

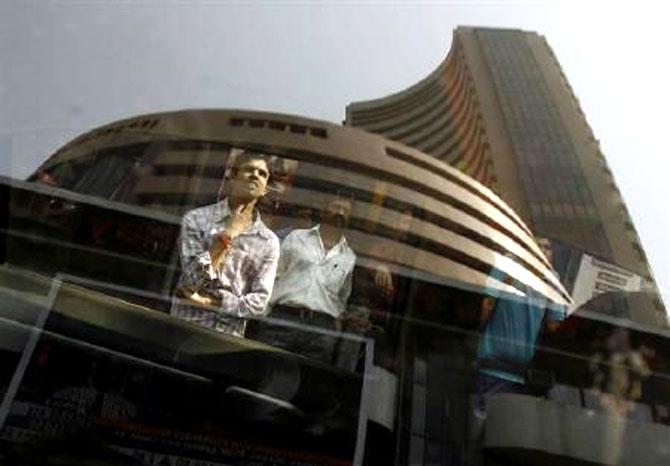

The BSE benchmark Sensex nosedived about 1,940 points to settle just above the 49,000-level on Friday, tracking massive sell-offs in world equities after a rout in global bond markets spooked investors.

The 30-share BSE index ended with a loss of 1,939.32 points or 3.80 per cent at 49,099.99.

Similarly, the broader NSE Nifty plunged 568.20 points or 3.76 per cent to close the session at 14,529.15.

All 30 Sensex constituents ended in the red.

ONGC was the top loser, shedding around 6.50 per cent, followed by M&M, Bajaj Finserv, Axis Bank, Kotak Bank, PowerGrid, HDFC Bajaj Finance and ICICI Bank.

Sectorally, banking index suffered maximum loss with over 4.8 per cent drop. Financial and telecom indices too fell sharply by 4.9 per cent and 3.85 per cent, respectively.

"Equity markets opened gap down following spike in global bond yields and extended its weakness further as the session progressed.

“Panic in global bond markets led to sharp rise in yields which spooked investors amid fears of interest rate cycle reversal," said Hemang Jani, head of equity strategy, Broking & Distribution, Motilal Oswal.

Vinod Nair, head of research at Geojit Financial Services, said, "Domestic markets tumbled in line with global trend triggered by a sharp rise in bond yields. Increasing geopolitical tension between the US and Syria aggravated the selling. Q3 GDP data which is to be released today also added volatility in the Indian market."

Although negative, mid and small caps outperformed their larger indices showing investor confidence, he said, adding the market will gain momentum as the global market is expected to stabilise supported by maintaining accommodative monetary policy and a growing economy.

Elsewhere in Asia, bourses closed with heavy losses due to a rout in global bond markets.

Most global markets traded lower after Wall Street's main indexes tumbled, following a steep rise in benchmark US Treasury yields.

On the forex market front, the rupee tumbled 104 paise to close at 73.47 against the US dollar.