| « Back to article | Print this article |

Dr Reddy's was the top loser in the Sensex pack, shedding around 5 per cent, followed by M&M, Tech Mahindra, Axis Bank, IndusInd Bank and TCS.

NSE Nifty sank 306.05 points to finish at 14,675.70.

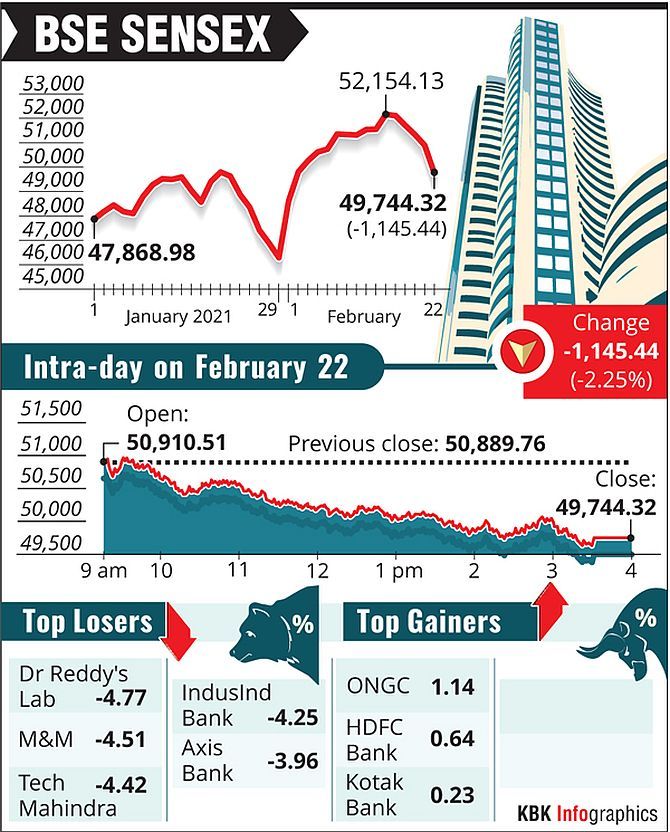

Spiralling lower for the fifth straight session, the Sensex plummeted 1,145 points while the Nifty crashed below the 14,700-level on Monday as across-the-board selling hammered stocks amid a prolonged spell of weakness in global equities.

A surprisingly firm trend in the rupee was not enough to bolster investor sentiment, which has been hit by rising COVID-19 cases in multiple states and concerns on the valuation front, traders said.

Posting its biggest single-day slump in two months, the 30-share BSE Sensex tumbled 1,145.44 points or 2.25 per cent to close at 49,744.32.

The broader NSE Nifty sank 306.05 points or 2.04 per cent to finish at 14,675.70.

The Sensex has now lost 2,409.81 points in five sessions, while the Nifty has shed 639 points.

Dr Reddy's was the top loser in the Sensex pack on Monday, declining 4.77 per cent, followed by M&M, Tech Mahindra, IndusInd Bank, Axis Bank and TCS.

Only three index components finished in the green -- ONGC, HDFC Bank and Kotak Bank, rising up to 1.14 per cent.

World shares retreated amid rising bond yields and a rally in select commodities, with investors monitoring the progress of the $1.9 trillion COVID-19 relief bill in the US.

"Rising economic restrictions from spike in virus cases and weak global cues hit the domestic market sentiment.

“The rate of market fall was aggravated by a sharp rise in volatility, being a monthly F&O expiry week.

"FPI inflows, which was leading the rally slowed down due to global vulnerabilities from rising bond yield and inflation.

“However, this is a buy on dip market, a short-term correction will trigger new buying, as economic fundamentals have improved, with more focus on industrial and cyclicals," said Vinod Nair, head of research at Geojit Financial Services.

Sector-wise, BSE energy, realty, IT, teck, auto and capital goods indices skidded up to 2.92 per cent, while metal and basic materials ended with gains.

Broader BSE midcap and smallcap indices fell up to 1.34 per cent.

Elsewhere in Asia, bourses in Shanghai, Hong Kong and Seoul ended on a negative note, while Tokyo traded with gains.

Bucking the weak trend in equities, the rupee gained 16 paise to settle at 72.49 against the US dollar.

Photograph: Shailesh Andrade/Reuters