| « Back to article | Print this article |

The Aditya Birla group has slammed rating firm Moody’s for placing Novelis, the group’s aluminium products subsidiary, in line for a possible downgrade to default.

The Aditya Birla group has slammed rating firm Moody’s for placing Novelis, the group’s aluminium products subsidiary, in line for a possible downgrade to default.

The group has said both Novelis and its parent Hindalco are "rock solid companies" and there is no question of a default by Novelis on its loans.

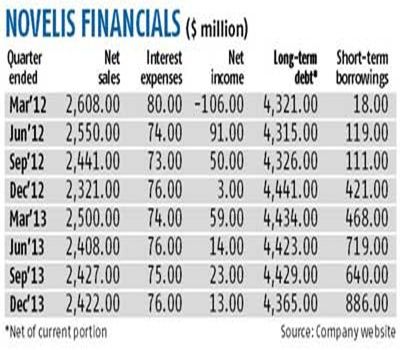

Novelis had $5.2 billion of loans on its books as of December 2013 and a part of these loans is guaranteed by Hindalco.

“S&P has rated Novelis ‘stable’ at B+ but Moody’s has taken only three months’ financial data into consideration for a possible review. We do not agree with their assessment,” a top Birla group official said, asking not to be named. Moody’s rival S&P, according to the official, takes a longer-term view while rating the company.

The North American company has invested $1.5 billion to expand capacity, which will add to its top line soon.

“Soon, the company will start benefiting from the expansion and we will see the results,” the official added. But jittery investors reacted negatively to the report as Hindalco’s stock closed 1.5 per cent down on the Bombay Stock Exchange at Rs 121 a share in a special two-hour trading session on Saturday. Novelis is 100 per cent owned by Hindalco, which took it over for $6 billion in 2007.

Moody’s said on Friday that the review for downgrade was due to a deterioration of debt protection metrics, as evidenced by a contraction in the earnings before interest and tax to interest (Ebit/interest) ratio to 1.7 times for the 12 months ended December 31, 2013 and an increasing leverage position as evidenced by the debt/Ebitda ratio worsening to 6.9 times for the comparable 12-month period from 5.6 times for the fiscal year ended March 31, 2013.

The company’s net income (net profit) also increased to $13 million from $3 million in the previous year. Net sales of Novelis were at $2.42 billion in December 2013 as against $2.34 billion in the December 2012 quarter (see chart).

In its February meeting with analysts, the company said it had recorded a strong performance in the December quarter amid challenges in various geographies and business segments.

The company managed to perform in a seasonally weak quarter that was gripped with overcapacity in both aluminum can production and can-sheet production.

Besides, low aluminium prices and tight scrap spreads was another challenge the company faced during the December quarter. Overcapacity in the mature North American beverage can market was the third hurdle that Novelis faced during the quarter, the company said.

Despite this, Novelis reported Ebitda of $203 million in the December quarter, up 10 per cent from the same period in the previous year due to improvement in volumes across all of the company’s regions, which contributed $61 million to Ebitda improvement.

The company reported the highest third-quarter shipments since fiscal 2008 with Asia and South America both achieving all-time high production and shipment levels in the third quarter, it said.

“Our execution in the third quarter was excellent, with year-over-year shipment increases in almost every operating region,” Philip Martens, president and chief executive officer, said in February.

The company’s net income increased to $13 million mainly due to higher Ebitda and an income tax benefit compared to the prior year, senior vice-president and chief financial officer Steve Fisher said in the earnings conference call.

“The strategy we set in motion several years ago to grow our portfolio of premium products, to increase the recycled content in our products and our disciplined approach to capturing growth through expansions will allow us to navigate through these headwinds and emerge a strong company,” said Martens.