| « Back to article | Print this article |

The compact segment where Sonet will be launched is crowded with the Maruti Vitara and Brezza, which top the sales' list, and a bevy of models from Mahindra & Mahindra apart from Hyundai's offering.

But volumes in this are slightly higher than those in the mid-segment, making it attractive, says Surajeet Das Gupta.

Initially it was being designed and built with only the Indian market in mind. But Sonet, the compact SUV from Kia Motors that has been designed collaboratively in its R&D centres across the world (including Hyderabad), drew attention in other markets.

So the car-maker decided that the Sonet would be manufactured in India and launched here first, but would also be sold in as many as 70 countries. And the markets identified for exports, to begin with, include Chile, Indonesia and Africa.

Kia has huge expectations from its new compact utility vehicle sub-four metre Sonet.

The pricing has not been divulged (experts expect it to range between Rs 600,000 and Rs 12 lakh) but the South Korean car-maker is hoping to replicate the magic of its mid-sized utility vehicle, Seltos, with which Kia made its India debut last August.

Aggressive pricing (Rs 9.89 lakh to Rs 16.3 lakh for Seltos), slick designing, smartwatch connectivity and connected car technology helped Kia reach the 100,000 sales mark in quick time, despite the impact of Covid-19 and the lockdown, which saw sales fall to virtually zero.

The car-maker says it has helped it to grab a 43.5 per cent share of the mid-SUV segment since its launch. This is despite the fact that it competes with Hyundai's Creta and Maruti's Ertiga and S-Cross.

The initial response for the Sonet has been encouraging. When bookings opened on August 21, Kia garnered over 6,500 orders (the upfront money was Rs 25,000).

If all goes well, the company is looking to hit the 100,000 mark with the Sonet in a year.

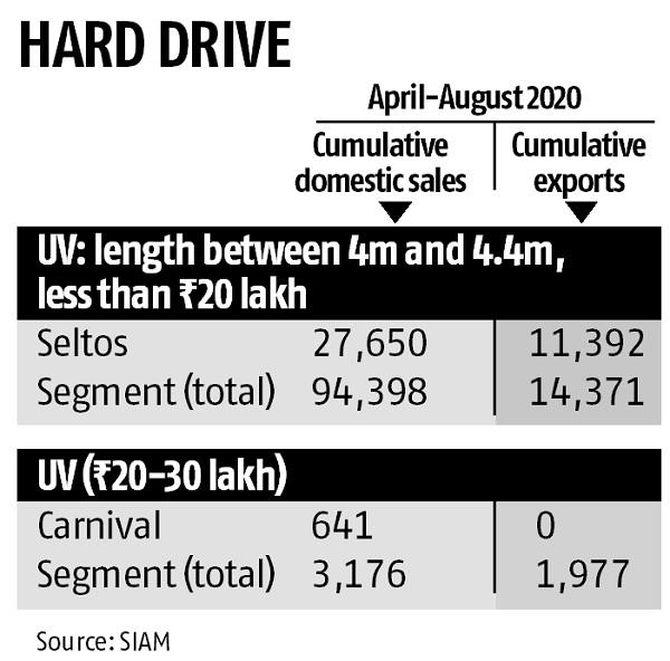

Insiders say that based on the trends of the Seltos, which accounted for 80 per cent of total exports in its segment in April-August (11,392), the Sonet could see decent export numbers, too.

Motors executives declined to participate or respond to questions for this article, saying they were busy with the launch. But in a series of interviews last year, H W Park, former president of Kia Motors, elaborated the company's goals -- a 5 per cent market share in three years, making India an export hub and sticking to SUVs and MUVs.

If things go as planned, India would be Kia's fifth largest market.

Kia's global projections reflect this ambition. In its annual report, it has targeted sales of 120,000 in India in 2020, almost a threefold increase from 45,000, which it clocked in 2019, the highest growth for any country in which Kia operates.

That would already, say analysts, bring its India share of total revenues from 1.5 per cent last year to around 4 per cent this year.

Its largest market is the US (where it has targeted to sell 630,000 cars this year) followed by South Korea, Europe and China.

In many ways Kia has leveraged its association with its older sister concern, Hyundai, which has an over 33.88 per cent stake in the company and is an established player in India.

And it is no secret that the two work together in many areas -- from sharing platforms and engines to strategising on markets and with personnel hopping from one company to the other.

The two also compete in the same segments with differentiated products. Auto experts say there might be some cannibalisation, but the two have together successfully grabbed a large part of the pie in the segment where they both operate.

So in the 4 to 4.4 metre UV segment under Rs 20 lakh, their combined share was 65 per cent between April and August 2020 compared to 45 per cent in the same period last year.

The synergies are clear. Sonet is based on the same platform as Hyundai's Creta, say auto experts. Similarly, the Seltos shares the platform with Hyundai's Venue.

Kia has also replicated Hyundai's learnings in the country. So both put in money to build a large plant as well as bring in vendors to support their India forays.

This helps start with a very high localisation (analyst say it is over 80 per cent for Kia, just as it was for the Santro), which pares costs that can be passed on to consumers through aggressive pricing of the car and spare parts.

Kia invested over $2 billion to set up a new plant in Andhra Pradesh with a capacity of 300,000 vehicles plus an adjacent vendor park.

That is more like Hyundai, which put in over $400 million with a capacity of 125,000 vehicles a year to kickstart its Indian journey with the Santro.

Kia has also built a sizeable dealership network -- estimated at 150 -- just as Hyundai had at the start. Also, key executives from Hyundai play a strategic role in Kia. For instance, Park was finance director and then MD of Hyundai in India before becoming Kia president.

But there are areas both need to keep a watch on. For instance, Kia's second car, the Carnival, which was targeted to take on Jeep and the Honda CRV (price between Rs 20 lakh and Rs 30 lakh) did not make waves.

Between April and August, it sold 641 vehicles, compared to 1,207 Jeep Compass sold by FCA India Automobiles.

“Given that it is way ahead as a product, the lacklustre sales of Carnival are a dampener. I think it is a positioning issue, rather than pricing, and they have to rethink. I hope it is not arrogance and complacency too early on,” says BVR Subbu, former president of Hyundai Motors India and consultant to auto companies.

The compact segment where Sonet will be launched is crowded with the Maruti Vitara and Brezza, which top the sales' list, and a bevy of models from Mahindra & Mahindra apart from Hyundai's offering.

But volumes in this are slightly higher than those in the mid-segment, making it attractive. The question is whether Kia will be able to replicate its success with another model. Or remain a one-model wonder.

Feature Presentation: Rajesh Alva/Rediff.com