| « Back to article | Print this article |

Given that Ford has a huge network in many emerging markets and M&M in South Asia, the combined distribution can cast a much wider net than each can alone.

Being a global player in passenger vehicles is a dream Mahindra & Mahindra has harboured for long. Earlier this month the homegrown maker of sports utility vehicles and tractors decided to give its ambitions wings by stitching up a deal with a foreign partner once again.

After two years of intense deliberations, which started in September 2017, M&M and Michigan-based Ford Motor have announced a joint venture in which Mahindra will control the majority 51 per cent stake, whereas Ford will transfer its entire India business, excluding the engine vertical, to the new entity. This will be M&M's third deal with a foreign partner.

The nuts and bolts of the deal are quite straightforward. Both companies expect to achieve cost synergies, pare product development time and cost and leverage each other's distribution reach to boost exports.

"The big benefit that comes to Ford and Mahindra is on the exports front. It opens up a lot of possibilities," M&M Managing Director Pawan Goenka told Business Standard.

Given that Ford has a huge network in many emerging markets and M&M in South Asia, the combined distribution can cast a much wider net than each can alone.

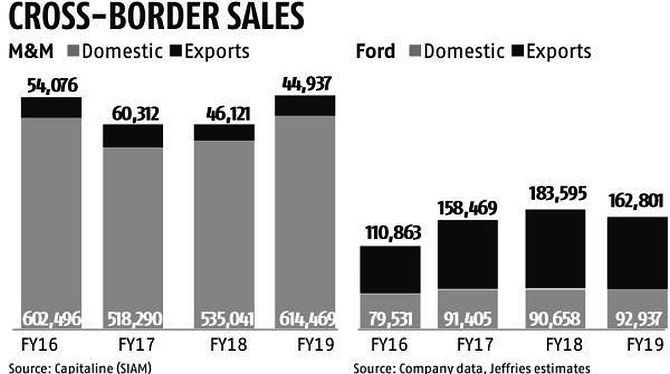

Ford's India business is also more geared towards exports, with six out of every 10 vehicles currently being made in the country exported.

For M&M, exports account for only 6.3 per cent of total volumes, and it expects the JV to give this number a boost.

Ford's struggles are more on the domestic front, where the venture with M&M could come in handy.

High cost structure, stiff competition from Japanese and Korean brands, frequent policy changes and cyclical swings have kept its domestic share at 2.8 per cent in 2018-19.

A lot is riding for both entities on the new models, including a C-segment SUV based on M&M's platform, a B-segment SUV based on Ford's platform, and a new MPV, being planned by the JV.

The companies are also working on the new generation Aspire electric vehicle. M&M has made an equity investment of Rs 657 crore into the JV, which is half the amount required to develop these products.

The real test for the co-developed vehicles, though, will be when they begin exporting their new models in about three years.

For the Indian market, the JV will stay clear from badge engineering -- where an existing model is changed by adding a new bade and subsequently marketed as a new variant.

The platforms co-developed by the new entity will have distinctive top hats and even body types bearing the DNA, feature, and styling of each brand.

For the overseas markets, though, the companies may resort to badge engineering. This will give the JV a larger bucket of products to export.

Some of Mahindra models may be sold through Ford's international distribution network, said Goenka.

Earlier this year, Ford Motor carved out China as an independent market from the Asia-Pacific region and formed an International Marketing Group (IMG) consisting of a hundred emerging markets as a separate cluster.

The cluster includes Africa, ASEAN, Australia, India, Mexico, the Middle East, New Zealand and South Korea among other countries and is expected to be operational by January 2020. Ford expects this region to account for one in three vehicle sales in the future.

But exports of passenger vehicles out of India haven't had much success, and the challenges faced by others remain for the JV as well.

"Exports are a complex exercise," says Mahantesh Sabarad, head of equity research at SBICAP Securities.

Automobiles go through frequent changes and every time there is a minor or major modification to a model, it has to go through homologation, or the process of certifying a product to indicate it meets the regulatory requirement in its destination country all over again.

This is a huge logistical challenge. Having a large basket of products alone doesn't guarantee success, exports have to be supported by after sales network, he added.

To be sure, Ford has been restructuring operations in weak markets globally, and the JV with M&M is a risk mitigation strategy.

As much as it would like to stay invested in India, given its demographic dividend, it could no longer afford to remain a marginal player amid high operating costs and intensifying competition.

Therefore, unlike General Motor, which exited India lock stock and barrel last year, Ford has decided on a middle path.

The deal helps the company hedge its bets in a market where it has failed to make deeper inroads despite a presence of over two decades.

"The only logic we see to this deal is that M&M needed to help Ford in its global strategy to reduce investments in non-core markets to ensure its commitment to a long-term strategic alliance which can benefit M&M through technology access and product development in the future," wrote Arya Sen and Ankur Pant analysts at Jefferies Equity Research in a recent research report.

One of the immediate concerns relate to the cumulative capacity the deal creates.

"We failed to understand why M&M is adding more capacity when its own plants' capacity utilisation is at less than 70 per cent, while Ford is at 60 per cent. We believe investors will be concerned about M&M's capital allocation strategy," wrote Hitesh Goel and Rishi Vora, analysts at Kotak Institutional Equities.

The two companies will have a combined capacity of 1.2 million units. Given Ford's limited success in India so far, analysts fear the entity would be saddled with excess capacity.

The other big question is that M&M's track record with alliances has also been patchy and analysts are sceptical of the longevity of the deal.

Its earlier partnership with Renault ended prematurely after five years following differences over the design of Logan, and its JV with with Navistar for commercial vehicles too didn't last long.

"I don't see this lasting beyond five years," said an analyst at a consulting firm.