| « Back to article | Print this article |

The current slowdown, which is a combination of complex regulations that go into effect next year, heightened competition across segments, and less-than-optimum consumer sentiment, has been the most protracted in a decade, and side-effects are being felt even by dealers who distribute vehicles to the end consumer.

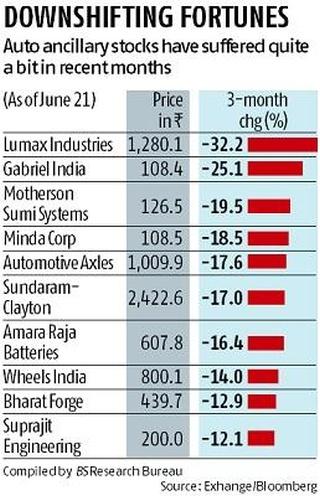

A slowdown in the automobile sector is having a cascading effect on component makers, with large listed ancillary firms witnessing their market capitalisation shrink on account of reduced orders, piled-up inventories, and an uncertain future.

The current slowdown, which is a combination of complex regulations that go into effect next year, heightened competition across segments, and less-than-optimum consumer sentiment, has been the most protracted in a decade, and side-effects are being felt even by dealers who distribute vehicles to the end consumer.

Even minor changes in regulations and law have had knock-on effects, hurting sales.

For example, the new norms that increased axle load by around 25 per cent last year mean that commercial vehicle operators can use eight instead of 10 vehicles to move the same amount of cargo.

The net effect: a 20 per cent reduction in sales. More recently, global brokerage house UBS downgraded passenger car market leader Maruti Suzuki, from 'buy' to 'sell' on account of sharp declines in volumes.

Lumax Industries, a maker of lighting parts, is feeling the pinch. "Lumax has definitely been hit by the effects of the slowdown, but the group is focusing on the future and changing regulatory standards," said Vineet Sahni, CEO at Lumax.

He added that Lumax was keeping its capital expenditure in check and future investments would be done based on emerging demand.

Motherson Sumi, Sundaram Clayton and Bosch India did not return messages and calls till the time of going to press.

Even with widely used ERP systems and cost optimisation software systems, it is a challenge for any component maker when the market leader, Maruti Suzuki, sees sales forecasts cut by as much as 20 per cent, with some models being withdrawn.

Sources said that for the month of June, players like Ashok Leyland and Maruti Suzuki even halted production for a few days.

"If the shop floor is churning out 700 vehicles versus 1,000 from the last month, everything is rationalised," an analyst said.

The domestic automotive component industry is comprised of around 800 firms and generates $40 billion in turnover.

Not all component makers are panicking, though. Arjun Jain, business head for the electrical division at Varroc Group, said his firm was better insulated from the slowdown because of its substantial dependence on Bajaj Auto for business in India.

"We are not bothering too much about what is happening in the market right now, but we do see that growth will not be that great," he said.

Ram Venkatramini, president of the Automotive Component Manufacturers Association of India, said the positive was that unlike auto manufacturers, ancillary makers catered to a host of different vehicle makers, both domestically and overseas, which meant they were not overtly exposed.

Vikas Sinha, senior vice-president, strategy and investor relations, Mahindra CIE, which makes forgings, stampings, and gear, said he was cutting back on spend.

"We are evaluating all our fixed costs and capex much more closely and exploring customer diversification, especially an increase in exports."

There are hopes that with China becoming less attractive to global OEMs due to the trade spat with the US, countries like India can benefit.

Sinha added that softening sales for two-wheelers, light commercial vehicles, medium and heavy commercial vehicles and tractors have been caused by an increase in cost of ownership related to financing difficulties, increase in oil prices, and increase in upfront insurance.

"Only in the passenger car segment, there could be structural issues like the sharing economy or congestion in major cities that could be affecting demand," he said.

Global MNCs like Delphi, Visteon, and Bosch may, however, have it easier because they are greater distributed to foreign markets across geographies and don't have the pressures that domestic players, the bulk of whose business comes from India, will be subject to.

When do players expect the downturn to end? Sahni said demand would remain subdued for a few more months but could revive during the festive season after the monsoon.

"The government support will be required in reducing taxes and the industry ought to focus on exports."

Venkatramini said ancillary makers should get into discussions with OEMs and take a call on what they planned to do in the next three months because -- downturn or not -- the next year, when BS-VI norms go into effect, promises to be a tricky one.