| « Back to article | Print this article |

An ordinance or amendment in the RBI Act may be required to extinguish the Reserve Bank's liability towards the de-legalised currency notes that are not returned to the banking system.

Sudipto Dey/Business Standard reports.

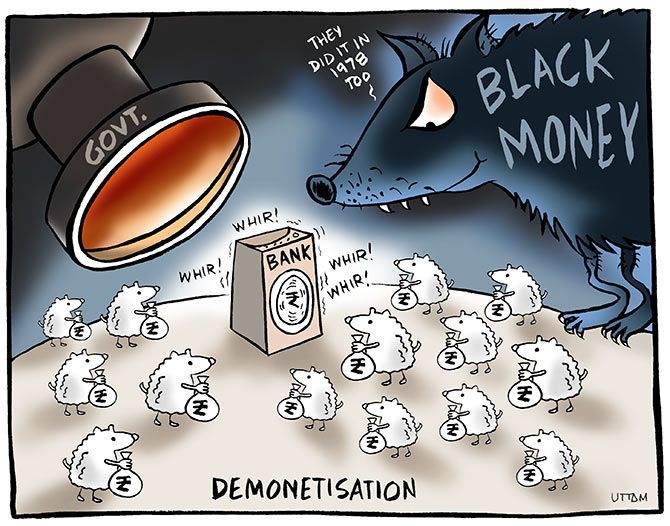

Illustration: Uttam Ghosh/Rediff.com

Even as the Supreme Court goes through the arguments for and against de-legalising of high-value currency notes, there is speculation that the government may take the Ordinance route to back the November 8 notification to ban the use of Rs 500 and Rs 1,000 notes as legal tender.

Even as the Supreme Court goes through the arguments for and against de-legalising of high-value currency notes, there is speculation that the government may take the Ordinance route to back the November 8 notification to ban the use of Rs 500 and Rs 1,000 notes as legal tender.

Going by precedents, legal and Constitutional experts point out typically any such decision must meet four requirements to be legally effective.

First, there has to be a declaration that a certain series of bank notes shall not constitute legal tender, followed by discontinuation of certain denomination of currency.

Then prohibitions are put on transfer or receipts of such bank notes and finally restrictions are put on the Reserve Bank of India’s legal obligations for exchange of such old notes with new ones.

In the previous two instances of de-legalising of currency notes -- in 1946 and 1978 -- the respective governments of the day relied on ordinances to give legislative stamp to executive orders.

The Narendra Modi government, however, notified the de-legalising decision using provisions under the RBI Act, 1934.

Section 26 of the RBI Act, 1934, empowers the government to de-legalise 'any series of bank notes of any denomination' by a gazette notification 'to such extent as may be specified in the notification.'

Further, Section 24 of the Act empowers the government to direct "non-issue or the discontinuance of issue of bank notes of such denominational values as it may specify," notes Debanshu Mukherjee, senior resident fellow, Vidhi Centre for Legal Policy.

These take care of the first two requirements. However every currency note still remains a liability on the books of the RBI.

"Each note carries with it a promise, signed by the RBI governor, to pay in full its face value. Even if certain notes can't be used in the economy, the RBI's obligation to honour its promise under law remains," says Shubhankar Dam, associate professor of law, University of Hong Kong, and an expert on Constitutional law.

Mukherjee feels the government may argue that the other legal requirements are covered under provisions of subsection (2) of Section 26 of the Act, read along with the RBI's powers to issue directions to banks in public interest under Section 35-A of the Banking Regulation Act, 1949. He is, however, quick to add that the tenability of such interpretation remains to be tested.

Some legal experts question the validity of de-legalising of the entire stock of Rs 500 and Rs 1,000 currency notes under Section 26 (2) of the Act.

Babu Sivaprakasam, partner-head banking & finance, Economic Law Practice, points out that Section 26 (2) refers to 'any series' of bank notes.

The moot question is whether 'all' or the 'entire' series of a particular denomination can cease to be a legal tender, he says.

If that is the case, then all the bank notes of all denominations can be declared as illegal tender in one stroke by a notification and the country can become cashless, he adds.

Experts say this reasoning augments well with the previous two de-legalising episodes. Section 26 A was inserted in 1956 pursuant to the 1946 incidence, while the 1978 promulgation of an Ordinance was followed by passing of an Act.

In the current case, an ordinance or amendment in the RBI Act may be required to extinguish the Reserve Bank's liability towards the de-legalised currency notes that are not returned to the banking system.

This is because the RBI's statutory liability in relation to such notes under Section 34 of the Act cannot be overridden by an executive notification.

Even if the notes are not legal tender, as they were valid when issued, the RBI would need to maintain a reserve for notes which are not surrendered for circulation, say some experts.

However, there is a debate among them over the legal sanctity of a timeline for exchange of de-legalised notes.

The March 31, 2017, deadline for exchange of such notes finds a mention only in Prime Minister Narendra Modi's November 8 speech.

Effectively, the RBI has left the timeline as 'to be specified,' while the ministry of finance notification has not addressed the issue.

Some feel the action of setting a timeline in an ordinance can be challenged on various grounds, including lack of precedence, global practice and Constitutionality.

Veena Sivaramakrishnan, partner, Juris Corp, points out that the November 8 notification stipulates the rationale for de-legalising of the currency notes as prevention of unaccounted wealth, stopping usage of fake currency in drug trafficking and terrorism and stopping damage to economy and security of the nation.

"Any challenge would also need to overcome the aforementioned grounds for which the central government otherwise has wide powers," says Sivaramakrishnan.

Mukherjee of the Vidhi Centre of Legal Policy adds that till date courts have typically intervened in executive action on economic matters only when the decision is patently arbitrary, discriminatory or mala fide.