| « Back to article | Print this article |

'Aditya Puri says the bank is positioning itself as the Indian Alibaba.

'The next wave will see the lender partnering with an array of fintechs globally that can plug into HDFC Bank’s system and offer their products and services to customers. This will be by way of an API that connects to the front end of the bank.

'Simply put, the mobile banking platform will act as a one-stop solution for anything and everything that a customer would look for.'

Tamal Bandyopadhyay details HDFC Bank's digital journey.

Here is a story that Bhavesh Zaveri, head of operations and technology at HDFC Bank, loves to tell.

There was a Parsi gentleman who used to visit a small restaurant in a quiet corner of the lane. He had begun patronising the café during his college days and maintained that habit over decades.

The restaurant became like an extension of his family -- he was familiar with the waiters, savoured the special tea, relished the bun-maska and enjoyed the service. Then an office complex opened nearby and the restaurant started getting more and more customers.

With patrons pouring in, the Parsi gentleman began seeing the quality of the tea deteriorating and the service became abysmal. After putting up with it for a while, he just stopped visiting the restaurant.

“The point is, we have tonnes of volumes coming in with the growth in business, and not necessarily in a certain pattern, but we can’t compromise on the service quality. If that happens, the customers will leave,” says Bhavesh.

The challenge before the bank is managing growth in transaction volumes without compromising on quality of service.

HDFC Bank’s transaction volumes are astonishing. As on 31 March 2018, it had 43 million customers. On average, more than 20 million cheques are processed by the bank every month.

The electronic payment numbers are much bigger. It processes more than 50 million transactions in a month through the RTGS, NEFT and ECH/NACH avenues combined.

The bank continues to have 50% market share in the value of transactions in capital markets. The retail asset instalment loans issued during an average month reaches Rs 110 billion. These are just a few examples.

Coming up with innovative products is difficult but selling them is even tougher. It is necessary to instil confidence in the front end that the bank has an attractive range of products.

Many still prefer going to branches. Convincing them to go digital was a task in itself. Front-end executives started approaching customers, giving them demonstrations of the digital drive, showing them how transactions were secured.

In the second stage, customers were tracked to ascertain that they had indeed migrated to the digital platform. As much as 80%–85% of the fixed deposits in the bank have now gone digital, reflecting the transformation in customer attitude.

From Large Companies to SMEs

The focus of the bank was on corporate clients in the beginning. It was a strong force in cash management and had very good relationships with the top 200 companies by 1998. It wanted to leverage this relationship to provide secured convenient banking products to customers.

Corporate internet banking, which is now routine, was then an innovative concept. ‘Digital certificates’ and ‘public key infrastructure’ were phrases that were bandied about but rarely applied.

HDFC Bank scouted for a technology partner that could co-create a solution. It found Solution Net Systems, Inc as partner and developed its own infrastructure to issue digital certificates to corporate customers and became the registering authority as there were very few such entities in the public domain at that time.

The Public Key Infrastructure (PKI) system enables users to securely exchange data over the internet and verify the authenticity and identity of the other party. A digital certificate, part of the PKI, is an electronic ‘passport’ that helps in authentication of the identity of the sender.

The bank launched its corporate internet banking product in 1999. Christened ENet, this platform started with basic account enquiry facilities but large corporations such as Reliance Industries Ltd, Tata Motors Ltd, Tata Steel Ltd and Mahindra & Mahindra Ltd, among others, kept pushing the bank to add more and more features to the platform.

It developed almost everything customers asked for -- that was the unique selling point. And what started for high-end corporate customers was later extended to accommodate mid-sized companies, small merchant establishments, stock brokers, mutual fund houses and so on.

As part of the digital transition, the bank is now working on migrating ENet into a new corporate internet banking platform. Here too, choosing the right technology partner is the key, entailing a painstakingly detailed evaluation process.

According to Bhavesh, with this transformation project, the bank should achieve the next level of digital banking for its corporate customers -- to provide a state-of-the-art and most up-to-date experience in terms of ease of banking and availability of products and services.

Saving 2 Million Sheets of Paper

Has the bank benefited? The digitisation drive has meant that the movement of documents has been slashed dramatically and this has saved around 2 million sheets of paper every month. The cost to earnings ratio shrank to approximately 40% from 49% between 2012 and 2018. Expenses have grown at a slower pace compared with the revenue earned.

The change is attributed not only to the digital products but also to the thought process. Besides, the move to digital created a new customer acquisition channel. It also helped in freeing the bank staff from their routine chores as customers are availing loans with just a click.

Have people lost jobs after the bank embarked on the digital drive? HDFC Bank has capacity models in place for its front-end and back-end infrastructure. The manpower capacity is worked out on the basis of quantitative modelling, using time and motion study.

With the advent of new technology, once customers started switching over to digital, the employee requirement declined.

Simply put, by going digital, the bank is able to get incremental sales productivity from existing staff by improving the turnaround time and getting end-to-end process through Straight through Processing (STP). This means while the business has continued to grow at the traditional rate, the addition to head count has not kept pace.

That this shift would happen, was brought home to Aditya Puri at an investor conference in Hong Kong in 2015. A Scottish portfolio manager at a large fund, which manages insurance money, cited the examples of Westpac Banking Corporation and Commonwealth Bank of Australia. She cautioned that people don’t want to give way in the face of digital transformations and would continue to do what they were doing. If that happens, costs don’t come down.

Aditya saw her point and decided to identify excess capacity. Very few were asked to leave but business heads were asked to not replace natural attrition, especially at the lower levels of the organisation. Attrition at the top and middle level has traditionally been low on account of long-term incentives like stock options.

So, from a peak head count of 92,000 people in July 2016, the number dropped to 84,000 in March 2017, which has since risen to 94,000 as of 31 March 2019.

Future of Bricks-and-Mortar Branches

What is the future of traditional channels such as branches and ATMs? Is the feasibility of the bricks-and-mortar model under threat?

On an investor call, Aditya said he did not have the answer but HDFC Bank was trying an experiment with the channel. It has reduced branch from 2,000-3,000 square feet to 800-1,200 square feet. That has meant lower costs and fewer employees. The result: They are breaking even faster.

HDFC Bank is adding 100-150 branches a year against as many as 500 a year at its peak. It also has metrics to judge the efficacy of an ATM.

Between 10 November 2016 and 30 December 2016, Rs. 15.41 trillion worth of currency notes of denomination of Rs 1,000 and Rs 500 -- about 86.9 % of the total notes in circulation -- were withdrawn, the third demonetisation drive in India since 1946.

After demonetisation, the profitability of many ATMs has dropped on account of low cash requirement due to digitalisation and charges for using cash machines in excess of a certain number of transactions. Customer behaviour has changed and cash transactions have declined, leading to a few ATMs going out of business and hence being closed.

Before demonetisation, it had 12,054 ATMs (in October 2016). Since then the bank has closed down some ATMs and relocated a few but the branch footprint is still being expanded.

While HDFC Bank adds hundreds of thousands of customers through its digital route, its branches will continue to welcome the customer, walking in to fund initial cash deposit into freshly opened digital bank account.

The idea is to combine assisted digital, self-service straight through digital with human touch-aided relationship banking so that the trust element -- key to the banking business -- is not compromised.

A VRM powered and assisted with artificial learning technologies will handle a bulk of the customer service requests even as a hot-line option for customers will remain to get into a live voice or video chat with customer service representatives.

In 2007, HDFC Bank launched ‘Classic on Phone’ -- a remote relationship management programme, which was the origin of VRM. It was a success but it could not be scaled up as the customer was not yet ready for it.

By 2015, the scenario changed and the high net worth customers were keen on availing services digitally, without it intruding on their time as would be the case with personal visits. The Phone Banking team was given the job of testing the waters. Thus, the Virtual Relationship Management programme was born.

It started with 500 VRMs in 2016 and by the end of 2018 at least 4,000 such managers were serving 6 million customers. The offering is through a human interface on the phone, catering to transaction and product needs of the customers with the help of an assisted digital journey.

Aditya is convinced that VRM is going to be the future and it can be among the largest revenue generating businesses for retail banking. He wants the VRM team to triple the revenue in the next 24-36 months.

Aditya’s mantra for the VRMs is fairly simple -- “Make use of available information (within the bank) of the customer, to have a meaningful conversation (this is the keyword) and provide services and need-based products in such a way that it leads to a positive change in customer’s relationship with the bank.”

The focus is on conversation; not just selling.

The bank has started leveraging the ‘computer vision’ to extract the PAN number from a scanned PAN Card on the mobile phone and pre-fill the ‘transaction request’ form for convenience and is also verifying the signatures on the cheque the customer has issued using machine learning algorithms.

However, an alert supervisory oversight with strong maker-checker mechanism keeps the bank reasonably figital -- a fusion of physical infrastructure and digital architecture, blending the offline and the online spheres.

Let me demystify the maker-checker mechanism. It has its origin in the so-called ‘four eye’ principle which means no transaction can be put through the system by only one individual, it needs two. The breach of this can cause a disaster.

The biggest banking fraud in India, unearthed in government-owned Punjab National Bank (PNB) in February 2018, illustrates this.

In this case, the origin was misuse of SWIFT messages. Banks across the world use SWIFT (Society for Worldwide Interbank Financial Telecommunications), a messaging network for securely transmitting information and instructions for all financial transactions through a standardized system of codes.

Here, to ensure safety, six eyes are required. The maker keys in the message in the system, the checker checks it and, at the third stage, the verifier transmits it after he is convinced of its genuineness.

What Next?

The bank has tied up with Netherlands-based Backbase to create the Backbase Omni-Channel Banking Platform. The state-of-the-art digital banking software solution unifies data and functionality from traditional core systems and new fintech players into a superior digital customer experience.

The aim is to provide customers the full financial experience instead of merely delivering products. The underlying motto is that if a customer wants to shop, pay, invest, trade, borrow, the only option in their mind should be HDFC Bank.

Aditya says it is positioning itself as the Indian Alibaba. Founded in 1999, Chinese online giant Alibaba Group Holding Ltd. provides consumer-to-consumer, business-to-consumer and business-to-business sales services via web portals, as well as electronic payment services, shopping search engines and cloud computing services.

The next wave will see the lender partnering with an array of fintechs globally that can plug into HDFC Bank’s system and offer their products and services to customers. This will be by way of an API that connects to the front end of the bank.

Simply put, the mobile banking platform will act as a one-stop solution for anything and everything that a customer would look for.

The plans of HDFC Bank are such that the bank wants to scale it up to have even Amazon, Google on its platform and offer them to customers through its website or app and also offer its products and services on the platform for merchants, e-commerce players and corporate banking customers.

This, HDFC Bank believes, is ‘banking at the edge’.

A digital bank, with self-service and computer vision to extract and process data from scanned images on the mobile device, and straight through API generating real time account number in core banking, can potentially add millions of new customers a month on their short taxi ride from home to the airport on the way to a holiday destination.

HDFC Bank, I understand, is rewriting its applications and recalibrating platform to become ‘Cloud Native’ -- which means these become elastic and can expand and contract automatically in sync with the workload.

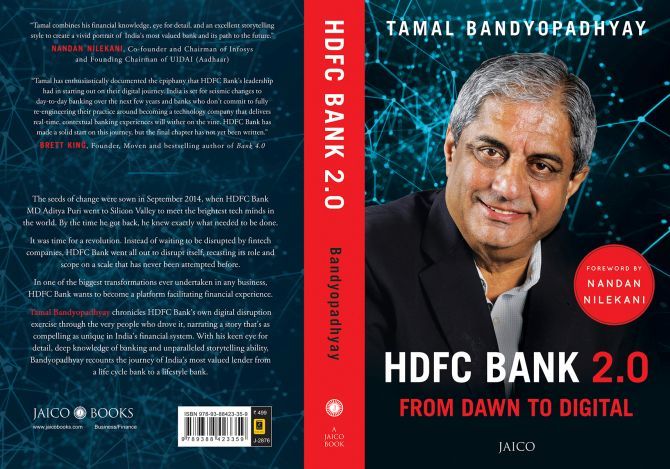

Excerpted from HDFC Bank 2.0: From Dawn to Digital by Tamal Bandyopadhyay, with the permission of Jaico Publishing House. Available for pre-order online and across bookstores on July 10.