| « Back to article | Print this article |

'There are two pre-conditions for big reforms. One, a sense of crisis and second, fairly concentrated levers of power.'

'India is growing at 7.5 per cent or something close to that.'

'Our levers of power are decentralised, not just between the Centre and states. Power is dispersed and there is no sense of crisis.'

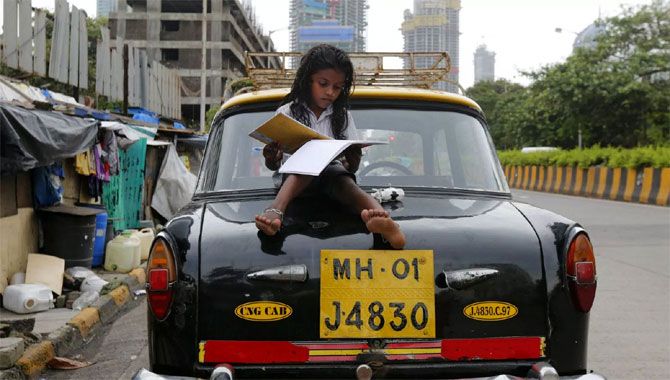

Chief Economic Advisor Arvind Subramanian, bottom, left, tells Shekhar Gupta on NDTV's weekly show Walk The Talk why it is now difficult to do a repeat of 1991.

It is one thing to be the chief economic advisor. Do governments take anybody's advice?

Oh, absolutely, I am pleasantly surprised by how much opportunity has been afforded to me. Finally decisions will be taken based on so many other things, but the space I have to analyse and then present the results to many people in the government, that is phenomenal.

That is letting you speak. Do they listen?

In the mid-year analysis before last year's Budget we made a pitch for more public investment because we said private investment was going to remain weak.

In last year's Budget one of the conceptual changes was to increase public investment. Even in this Budget there are lots of ideas -- direct benefit transfer in fertiliser, the Aadhar Bill. These are important changes.

Tell us about some of the things you have been able to do opportunistically.

The Jam Agenda. JAM stands for Jan Adhan-Aadhar-Mobile. In a way it fits with the minimum government, maximum governance idea of the prime minister.

Take the cooking gas scheme, we saved about 25 per cent by eliminating the ghost accounts. And it has been in operation for 18 months.

That is a lot of money.

That is a lot of money.

The potential for extending this to other areas is enormous. We have food, kerosene, fertilisers. Essentially, what it says is that the government can do things efficiently if you build state capacity and therefore state legitimacy. It is not just about the fiscal savings, it is saying how we can improve government functions.

Which is the least deserved subsidy of all?

We discovered that something like 80 per cent of gold is consumed by the top people, who travel by airplane and receive the benefit of low input cost. That seems like not the best use of government money.

How does the gold subsidy work?

In the case of gold, what is the rate of taxation? The excise rate is something like 14.5 per cent so it should be 28 per cent on commodities. In the case of gold it's zero at the Centre and 1 per cent in states.

Not taxing gold at the standard rate is the implicit subsidy.

I realise that something is high in subsidy because there is a prior interest preserving that. But the job of an economic adviser is something called the Dracula effort, shed sunlight on the problem and maybe there will be change.

The related point is also to try and understand who is the beneficiary of some of these things.

One of the points we try to make in this survey is that we are generally a country with a very few taxpayers. Our ratio of taxpayers to voters is four per cent.

People have to understand that when you vote you discharge your obligations as a political citizen. When you pay taxes, you discharge your obligations as an economic citizen. And both should go hand in hand.

How would you convince the people of India that we need one more round of reforms like 1991?

There are two pre-conditions for big reforms. One, a sense of crisis and second, fairly concentrated levers of power.

India is growing at 7.5 per cent or something close to that. Our levers of power are decentralised, not just between the Centre and states. Power is dispersed and there is no sense of crisis.

Are we going to get 7.5 per cent? There are no jobs, there are no raises, there are no bonuses, houses are lying empty...

You have to look at the numbers. There are sectors that are doing well. The economy is sending mixed signals. That is the truth.

Isn't the government sending mixed signals? Why this protectionism (over steel)?

I don't want to be an apologist for all government actions, but there is no doubt that there is excess steel capacity in the world. There is lot of unfair competition from countries. People are dumping.

We need better machinery to be able to impose measures that are sanctioned by the World Trade Organisation. Our machinery for imposing anti-dumping duty needs to be strengthened. Finally, the minimum import price comes with a sunset clause and, hopefully, it will not be renewed. But you need to provide some temporary protection.

An Indian automobile maker, his exports will now become non-competitive, he creates more jobs than a steel maker...

That is a difficult calculation. The broader point is well taken that there are downstream users and their interests are also to be protected. Therefore, any such measures should be calibrated and they cannot become permanent.

While we are doing this we should also try and take other measures to rationalise what is happening in the steel sector.

There are some companies that are completely uncompetitive and are never likely to be competitive. We should think about how to facilitate their exit.

Why should there be an exit once you enter the market?

Any market system can only function if efficient firms survive and inefficient firms do not. Over the last 40, 50 years we have made a lot of progress in allowing entry. Even in the last two years, liberalising foreign direct investment has been an enormous move.

Exit in India is much more pervasive than we think it is. That is why I think the bankruptcy law is important.

What we are doing in terms of banks, the power sector. We have to grind our way through project by project and see how we share the burden.

You think that is also the approach to the banking crisis?

The RBI has its asset quality review, which is basically saying let's come clean on all that we have. The finance minister has said we need more money and we will put in more money. That is the way forward.

Meanwhile, we have to address recognition, recapitalisation, resolution, and then reform.

We have to make sure that if we solve this, we don't repeat it.