| « Back to article | Print this article |

'For equities, inflation trending upwards but within the range of expectations can actually be a big positive as it helps earnings and may shift flows from bonds to equities.'

March 2021 quarter corporate earnings and the second wave of Covid have kept the markets busy over the past few weeks.

Manish Gunwani, CIO-equity investments at Nippon India Mutual Fund, tells Puneet Wadhwa that though reduced activity is likely to hit near-term earnings of domestic sectors, the two-three year outlook on corporate earnings growth remains robust.

The markets have been relatively resilient in the wake of the second Covid wave. Until when can this last?

There are multiple reasons for this apparent disconnect.

First, the Indian stock market is not only about India -- a fair bit of earnings come from sectors linked to the global economy (IT, pharma, commodities etc) and this segment is doing pretty fine.

Second, a lot of listed companies are gaining market share over smaller players.

So even if the industry growth is slow, earnings of the listed universe are not getting affected that much.

Finally, stock markets discount the future and the general belief is that this Covid phase will get over reasonably soon -- the success of vaccines in some prominent countries has been a big factor in this view.

How are you navigating this uncertain phase?

Generally, our diversified equity funds are benchmark-oriented and we do not believe in timing the market too much and do not take any big cash calls.

The market offers a steady compounding return in the medium-to-long term.

Hence, we are not changing our investment process too much.

How big a threat is inflation and other macro variables to the market's stability?

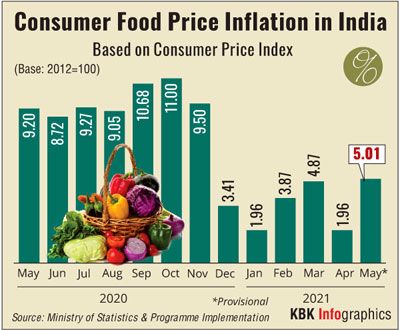

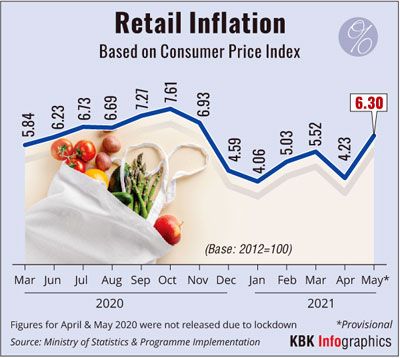

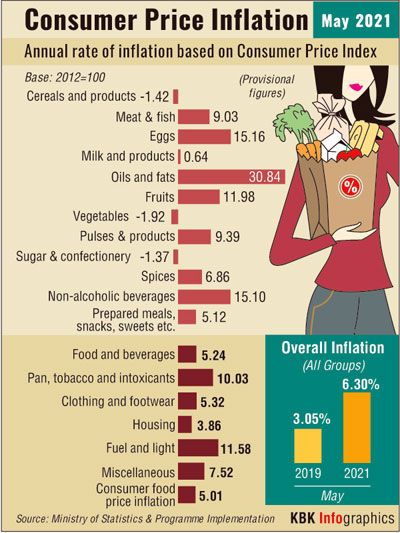

Inflation is probably the biggest threat to the global markets right now with commodity prices firming up.

Most developed markets are witnessing employment levels going up, which may drive wages higher.

For equities, inflation trending upwards, but within the range of expectations can actually be a big positive as it helps earnings and may shift flows from bonds to equities.

However, this can work to a certain level. If inflation overshoots expectations materially, it can be a big headwind as interest rates go up.

From an Indian perspective, one silver lining is crude oil that is expected to be range-bound due to alternatives like renewable energy becoming cost-effective.

Also, capacity utilisation in many sectors is still low, which may help control inflation.

Do you expect earnings downgrades over the next couple of quarters?

While the Covid second wave has led to reduced activity and is likely to hit near-term earnings of domestic sectors, the two-three year outlook on corporate earnings growth remains robust.

A lot of sectors like banks, commodities, telecom, and pharma have endured a down cycle in earnings during the long phase of 2015-2020.

The striking feature of the last few quarters has been that despite the economy enduring a titanic challenge like Covid, earnings have surprised on the upside.

Do you see more headroom in the specialty chemicals and pharma sectors?

The shift of select manufacturing sectors from China to India continues to be a strong structural theme and chemicals/pharma are well placed to benefit from it, given the strong ecosystem built over many years.

However, in general, stocks are expensive in these sectors but select a few may still offer steady compounding from here.

Have metal stocks run up too fast, too soon?

The sensitivity of metal stocks to commodity prices tends to be high and added to that, most of them have significant debt on balance sheets.

So in an upcycle, there is financial leverage as well.

Given the ferocity of the rise in metal prices, naturally, stocks have run up quickly.

While commodity prices are likely to cool down, the windfall profit metal companies are making will enable them to deleverage substantially, which can improve their multiples.

Some more upside is possible in the sector.

What's your strategy for the BFSI segment?

It is quite natural that with a crisis like the Covid second wave, the outlook on asset quality worsens in the short term.

Large private banks will be able to weather this storm much better than other segments and gain market share.

Second-level players not only have the issue of asset quality but also the fact that with technology becoming a big part of the competitive edge, ability to make adequate investments and attract the right talent are becoming steep challenges.

How do you see the consumption story play out over the next few quarters?

While discretionary consumption is likely to be affected in the short term, the robust balance sheet of households and huge under penetration of many goods and services should lead to consumption remaining strong after this pandemic.

The urban mass affluent consumption will likely recover first, as the balance sheet impact is much less in this segment.