| « Back to article | Print this article |

'India is in a slowdown which most of us have not seen in our living memory.'

Illustration: Dominic Xavier/Rediff.com

"Even if you are climbing out of the hole, you are not really climbing out fast enough," Priyanka Kishore, the economist behind the Oxford Economics report on the Indian economy -- A reopening gone wrong, which paints a grim picture of India's economic future post-Covid -- tells Shobha Warrier/Rediff.com in the concluding segment of a two-part interview.

Will you say a stringent lockdown is inversely proportionate to faster economic recovery?

In some sense, yes. Especially if the government did not compensate by giving more cash transfers to vulnerable people, or give ample support to businesses so that they do not lay-off employees and are in a better position to benefit from reopening.

You are out of the lockdown, but layoffs are beginning to happen now in the organised sector.

That's because businesses are faced with lower demand, and the government did not have any employment protection plan in place.

The higher unemployment, in turn, would lead to reduced consumer spending and further weigh on demand, and so on and so forth.

So, I would say the stringency of lockdown is inversely proportionate to economic recovery in India's case.

Do you feel the stimulus package offered by the government did not excite the market mainly because the private sector did not have the confidence to invest?

The stimulus package was mainly offering cheap credit to businesses, whether they are large or small or medium. They did not provide any benefits or wage subsidies to retain employees to ensure continuity when the economy opened up.

So, when companies start laying off employees, people are losing income which will lower demand further.

In a way, you are automatically adjusting down your growth and demand expectations for your sector which, in turn, will affect output. This was what happened with the stimulus package.

Your study said India's GDP growth would lose momentum from late Q3 on. Do you feel the impact on the economy became more severe because the economy was slowing down even before the pandemic came?

Yes, that is very much the case. The country was dealing with balance sheet concerns both on the financial and the non-financial side.

Now, even though the bankruptcy law has been suspended, the reality is that these balance sheet stresses have likely worsened during the lockdown and once things resume, more companies would file for bankruptcies.

And on the financial front, NPAs would rise because of that, leading to renewed tightening of credit conditions and prolonged weakness in private investment. So, it is going to take longer to resolve the legacy issues.

You say that 80% of covid cases are in the urban hot spots which contribute to 70% of India's GDP, and hence India's economic recovery will be bleak. How bleak is it going to be?

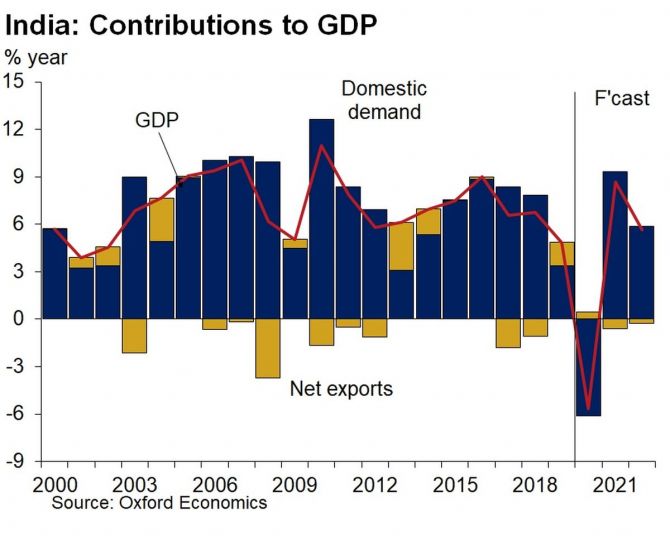

I feel that there is going to be a 6% plus contraction on the fiscal which is quite bleak for India.

There will also be a double digit contraction in Q2.

So, even if you are climbing out of the hole, you are not really climbing out fast enough.

On an annual basis, you are not going to see any positive growth this fiscal year at all. Q4 of FY21 also will still be negative in my forecast.

The IMF says the Indian economy is going to contract by 4.5% this year while some Indian economists feel it will be a 15% to 20% contraction.

For the first time since 1979, the Indian economy is contracting like this. Are we in an economic depression?

I think it is fair to say India is in recession. Recession is defined as two quarters of negative GDP growth.

On a q/q basis, I don't forecast that. But the more generalised definition of a significant decline in economic activity, lasting more than a few months, normally visible in real GDP and monthly indicators from NBER (National Bureau of Economic Research), does apply in the current circumstances.

India is in a slowdown which most of us have not seen in our living memory.

How long do you think this negative growth will go on? Some say it may continue for two years.

Two years is a long time. I think there will be a recovery sooner.

India is an emerging market with a lot of catch-up potential. It went into a sudden stop, and is coming out slowly.

There will be a recovery, but the question is, will it be a smooth recovery, or will there be another setback?

I am of the opinion that there will be an initial bounce back, and then things will not be that smooth going forward.

The recovery will be choppy, with ups and downs.

What I am forecasting is, India is not going to get as strong a medium-term recovery as others in the region. Though statistically you will get a bounce back in 2021 with may be 8% growth.

In 2022, growth will likely fall back again way below 6% as base effects fade.

At one point of time, India's growth was always 7% to 8%. It is only in the last 5-6 quarters, before the pandemic that India started getting used to the new normal of 5% to 5.5% growth.

The government is talking about green shoots starting in the rural sector. Do you think the rural sector will be able to guide the economy in its recovery process?

It is definitely leading the recovery process.

It is definitely leading the recovery process.

It is true that the rural economy employs a large section of the population and partly because of higher employment generation under MNERGA, we see more rural demand emanating.

Having said that, eventually from the output perspective, agriculture and fisheries contribute a very small percentage of the overall GDP.

India's GDP is services driven as 50% to 55% India's GDP is contributed by services.

Manufacturing has 15% to 16% share and the rest is agriculture.

Services and manufacturing are concentrated in urban areas.

When the rural sector drove India's economic growth, a lot of it was because of infrastructure investment and construction happening in rural areas.

Right now, that is not the case. It was in urban areas that construction was happening, but now, it has come to a near halt with the exodus of migrant workers, rising virus cases, renewed shutdowns etc.

So, I don't think the rural economy can offset the negative pressures from the urban demand. It will provide a bit of a cushion, but it doesn't have the strength to drive the entire economy.

You said 50% to 60% of the Indian economy is services driven. It means how the global economy fares is very important.

Now that the US is really suffering and its economy contracting around 33%, how much is this going to affect India?

Yes, it is the same story globally also. In the US, you see a situation similar to that of India with states moving away from the central plan of opening.

Our indicators show the US economy's recovery stalling and even coming off. So, globally we are seeing a bit of a drag on demand.

The only global silver lining is China which returned to growth in Q2 and could potentially lead to some pickup in global demand.

Nonetheless, with the major western economies struggling, whatever pickup in world growth you are likely to see in Q3, may lose some force by the end of the year.

This means that the recovery in Indian exports, which is one of the silver linings currently, may lose steam as well

Your study says India's recovery has to depend on exports as domestic demand is not going to rise soon.

When you look at the aggregate number for the entire year, it is going to be like that. A part of it is because net exports are exports less imports, and you now see a total collapse in imports.

If you look at the monthly trade figures, exports did well from -60% to -12% which was a faster recovery than we were expecting.

But imports are very disappointing, and remain near the bottom showing how weak the country's internal demands are for goods and services. That is a reflection of weak domestic demand.

As you emerge out of it, probably by the end of the fiscal year, you may start seeing more growth coming from domestic demand, and imports picking up in tandem, and net exports not multiplying so much.

But in the first half of the year, because this trend is so strong, you see domestic demand is subtracting from growth, and net exports are adding on to growth.

How do you compare Indian economic situation compared to the other Asian economies?

I think between India and the Philippines, India is in a race to the bottom for the worst performing economy in 2020.

Indonesia is also grappling with rising virus cases, but seems slightly better off than these two. Indonesia's case is quite interesting as they didn't lock down and implemented quite weak social distancing measures. They are also under reporting their cases because they are worried it will affect business confidence.

What we have found is that the short-term economic impact of the pandemic could be less severe in Indonesia compared to India or the Philippines. But it will likely take a long time to reach pre-covid growth level like India and the Philippines.

So, these three countries are basically at the bottom. In the middle are Singapore, Malaysia and Thailand who are already showing some improvement.

Of course, at the top is North Asia -- Vietnam, South Korea and Taiwan.