| « Back to article | Print this article |

'Indian economy can worsen further.'

'The government, in order to provide stimulus, has to be more active and involved in economic activity.'

'Modi has been an interventionist.'

'Some of his policy measures are well-meant, but all of them have not worked out well.'

'The intervention in J&K and shutting down all communication, in my view, was a disaster and sent out a wrong message to the investing community.'

The sudden attack on Saudi Aramco’s facilities saw oil prices flare up and dented sentiment across global financial markets.

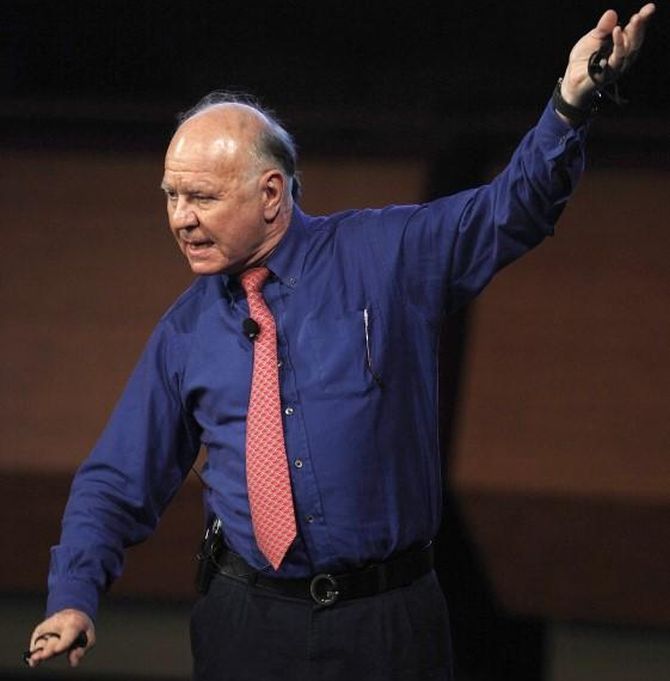

Marc Faber, editor and publisher of The Gloom, Boom & Doom report tells Puneet Wadhwa there are pockets of value emerging across the globe.

However, at the current juncture, some part of the portfolio should be in cash. Edited excerpts:

How are you viewing the debate around the overall economic slowdown in India?

The recent economic data has been very disappointing.

We are not in an overall recession, but some sectors like automobiles are suffering.

This suggests consumption is not particularly strong.

Such is the case with most global economies now - be it Europe, the United States (US) and Asia.

Manufacturing PMIs are weakening.

If the world wants to grow again at a healthier pace, it would be best for the governments to step back and not do anything.

In fact, the best way to re-stimulate the global economy is that the respective governments, as a percentage of the economies, shrink.

This means their influence on economic activities should diminish, which would allow the private sector to take over and grow at a faster pace.

This is not a conventional view, but my own opinion.

If you look at the last 100 years, in Europe and the US, the larger the government became as a percentage of the economy, slower the economic growth became.

Indian economy can worsen further.

That’s because the global economy is weakening and India is not decoupled.

The Indian government has announced a lot of policy measures over the past few weeks to stimulate the economy. Your views?

I am not a great believer in stimulus measures.

The government, in order to provide stimulus, has to be more active and involved in economic activity.

This, in turn, means more bureaucracy, which has been one of the main problems of India.

Prime Minister Modi’s government is just like the other governments across the world – be it Donald Trump or Xi Jinping.

Modi has been an interventionist.

Some of his policy measures are well-meant, but all of them have not worked out well.

There was a riot in Hong Kong and everyone has been focussing on that.

However, what Modi did in Jammu & Kashmir (J&K) is much worse.

The intervention in J&K and shutting down all communication, in my view, was a disaster and sent out a wrong message to the investing community.

There will be more problems in the region over time.

Are you looking to invest in India?

No, not for the time being.

Though the long-term economic outlook for India is favourable, the valuations right now are steep.

If I have to pay 50 – 60 times the earnings for good companies, it is not worth my money.

Technically over the long run, investors who put in money in high dividend yielding stocks are among the best performers.

Value can also be derived by studying price-to-book value (P/BV) etc.

But on all measures, Indian markets are not particularly cheap.

They need to decline another 30 per cent from the current levels for the valuation to become attractive.

That said, what the government has not done aggressively thus far is cleaning the banking system and effectively tackle the non-performing asset (NPA) issue.

Which regions globally appear attractive then?

The demonstrations in Hong Kong had an impact to make valuations attractive.

The leading real estate companies there are selling at a 50 per cent discount to the asset value.

So, investors can buy the stock at a deep discount compared to the asset value, which is the property they hold.

Another region is Malaysia, where banks are available at a reasonable price.

There are good dividend yield options there. While it is too early to buy there, investors should also keep a tab on Brazil and Argentina.

That said, there are oil stocks / oil-related companies across the globe that can be bought into.

There are pockets of value emerging across the globe, but investors are in no rush to buy right now and be fully invested.

At the current juncture, some part of the portfolio should be in cash.

So, which global currency is looking good?

There are a lot of options – from the US dollar (USD) to the Indian rupee (INR), euros, Singapore dollars etc.

Surprisingly this year, one of the strongest currencies has been Ukraine’s hryvnia.

Russian rouble has also done well, so has Thai baht.

I think for the next 12 months, one of the most important decisions that investors will have to take is whether they want to be long USD or will they be overweight on euro.

Where do you see oil prices headed in the short-to-medium term?

There is a geopolitical angle to the oil prices now.

Some of Saudi Aramco’s facilities have been destroyed.

If it comes to war, which is not totally unlikely, oil prices can flare up.

If there is no war and the situation stabilizes, the equilibrium price of oil is between $ 40 – $ 60 a barrel.

That said, there have been forecasts earlier for $ 20/barrel as well.

While it can slip to those levels temporarily, it cannot trade at those levels for too long.

In case of a global recession, it can slip below $ 30/barrel for some time, but will eventually bounce back.

In the worst-case scenario and there is a full-scale war in West Asia, it can go beyond $ 100 a barrel mark.

As an investor, I prefer to hold oil as a hedge against a possible war.

How do you see the global central banks respond to the economic slowdown over the next few quarters?

Albert Einstein said insanity is doing the same thing over and over again and expecting different results.

We have had negative interest rates in Japan and the European Union (EU) for a long time.

Now, the central banks want to go more negative to stimulate growth.

It is a complete fallacy.

The US Federal Reserve (US Fed) has more serious issues at hand given its domestic economy.

While the consumption there is strong, the credit situation is worsening.

The US Fed, along with the other institutions across the globe, is also worried about the trade tussle with China.

Going ahead, the policy focus of most central banks – the US Fed, Bank of Japan (BoJ), Bank of England (BoE) etc – will shift to the fiscal side or ‘helicopter money’.

Money can be sent to taxpayers or the taxes for the lower income group can be cut.

In the US, nearly 50 per cent of citizens do not pay taxes.

So, in order to reach those people, taxes have to be cut at the state level.

However, the Federal Government does not have any authority over that.

On the other hand, the states are in dire need of funds.

Either way, the fiscal deficit will grow over time.

Gold prices have been on a rise. Is there more headroom?

We have seen a good move from around $ 1,200 per ounce to over $ 1,500 now.

I think the prices will head higher going ahead, particularly in a low / negative interest rate regime.

In India, gold demand recently has been very weak.

That suggests the consumers are not in a good shape.

Photograph: Jessica Rinaldi/Reuters