| « Back to article | Print this article |

Investors should use the correction to buy in looking to individual stocks and not the indices, which are more sentiment indicators rather than that of value, says Sonali Ranade

Currency markets are still the driver of other asset prices. The mighty dollar may have just finished a bullish correction to its first rally from 73 in May 2011 to 84.25 in July 2012 and may be headed towards the 84 region again.

The US economy is among the strongest after its discovery of shale reserves and fracking. Real wages have fallen low enough to win back jobs from abroad. The financial system is in better shape and the Fed has avoided confusing the markets with a consistent policy, which says it will replace liquidity lost by de-levering in the off-the-books private sector credit markets with its own balance sheet expansion.

The US economy has recovered and the rally in dollar over the last 12 months reflects that reality. Yes, financial markets need to correct because as the $ regains value, asset prices must adjust relative valuations. So in a sense the correction that we now see is more about a pause to adjust than a resumption of a long-term bear market.

Shallow, sideways corrections [at least to begin with], don’t mean there aren’t over stretched greedy pigs in the markets. The froth in the Russell 2000 space says there is plenty of that critter awaiting slaughter. Neither are the hyped up metal and other commodity markets free from weak hands that bought the wrong thing at the wrong time at a wrong price.

So the shakeout in some sectors will be brutal, and since cash is fungible, trouble in a few sectors spills over to other sectors as margin calls need to be met. So don’t assume “fundamentals” will save the day for traders.

Interest rates in the US, and world markets show every indication of inching up. This has huge one-time implication for commodity and equity markets that have a positive cost of carry. The story of funds rotating out of bonds into equity is over hyped but cost of carry is pretty much real.

US Dollar [DXY]: The most important development in financial markets during the week was the breakout of the USD above its overhead resistance at 81.50. The currency index closed the week at 81.5850. The event resolved the wave count by confirming that the correction in the value of the dollar from it top of 84.25 was complete and the long-term bullish trend in the currency has resumed.

US Dollar [DXY]: The most important development in financial markets during the week was the breakout of the USD above its overhead resistance at 81.50. The currency index closed the week at 81.5850. The event resolved the wave count by confirming that the correction in the value of the dollar from it top of 84.25 was complete and the long-term bullish trend in the currency has resumed.

DXY could pull back in the ensuing week to test its new floor at 81. However, over the longer term, the index is headed towards the 83 area and could go even higher to test its previous top at 84.25.

The value of the dollar could unsettle the entire commodity world and perhaps even the equity indices.

EURUSD: EURUSD broke fell through its 50 DMA to close the week at 1.31880. With that the currency signalled an intermediate correction that will eventually test its 200 DMA, which is currently in the region of 1.28.

EURUSD: EURUSD broke fell through its 50 DMA to close the week at 1.31880. With that the currency signalled an intermediate correction that will eventually test its 200 DMA, which is currently in the region of 1.28.

The euro is poised exactly at the current rally’s base trend line and could pull back a bit before taking out the support. But barring such pullbacks, it appears to be headed for the next logical target at 1.2950.

USDJPY: The dollar paused just under its overhead resistance at 95 for correction closing the week at 93.38. There is no logical reason why the rally in the USD in the yen market should halt under 95 level.

USDJPY: The dollar paused just under its overhead resistance at 95 for correction closing the week at 93.38. There is no logical reason why the rally in the USD in the yen market should halt under 95 level.

With the DXY breaking atop 81.50, the USD should test the overhead down sloping trend line of the USD against the yen, which currently is in the region of 102.75. Won’t happen next week but the rally of the USD in yen markets is far from over. Yen finds support at 90.

USDINR: The dollar closed the week at INR 54,.26 just above its 50 DMA but just short of its 200 DMA.

USDINR: The dollar closed the week at INR 54,.26 just above its 50 DMA but just short of its 200 DMA.

The INR market appears mighty confused about the value of the dollar. It’s been hovering around its 200 and 50 DMA pair since early October, alternatively going above and below them while the two averages move closer. May be the Lords in RBI are confused themselves.

There is a curious negative correlation between the DXY and the INR that I can’t detail here. But it’s close and has held since the beginning of 2012. On the basis of this, I will go back to my previous wave count – one that says the dollar will test 57.25 in the not too distant future. Watch for a break above INR 54.50.

10-year UST yield: The movement in yields has been deceptively small but the trend should be obvious from the weekly charts above. The 10 year UST yield stood at 1.97.

10-year UST yield: The movement in yields has been deceptively small but the trend should be obvious from the weekly charts above. The 10 year UST yield stood at 1.97.

The 10-year notes peaked in price at 135.90 in June 2012 and have been drifting down since as yields have crept up. They closed the week at 131.91. In the process, they fell through an important support at 132.

The next logical support area for the Notes is now 130.50 followed by 128.50. That corresponds to yields creeping up to 2.20 per cent.

Gold: Gold was an unmitigated disaster as expected and closed the week at 1572.80 after making a low of 1554.30. The next logical target remains $1525, which could be tested over the next few weeks. Gold has time to get there and beyond.

Gold: Gold was an unmitigated disaster as expected and closed the week at 1572.80 after making a low of 1554.30. The next logical target remains $1525, which could be tested over the next few weeks. Gold has time to get there and beyond.

The intriguing question is, will $1525 hold? Markets always surprise and my sense is that that gold may test 1425 before it launches into a bear rally. So watch out for surprise moves!

Silver: Silver closed the week $28.46, a nick below its first support at 28.50. It could pull back a bit from here but the next logical target remains $26.

Silver: Silver closed the week $28.46, a nick below its first support at 28.50. It could pull back a bit from here but the next logical target remains $26.

The tricky issue really is will $26 hold for silver? Like gold, my sense is that the market would surprise to the downside and we may well see silver testing $20 before a bear rally unleashes its correction.

A lot of gold and silver is in weak retail hands owing to the well-publicised benefits of investing in gold as mother-of-all hedges. Without a huge price surprise and panic, how would you shake out the loonies?

HG Copper: Copper closed the week at 3.5330, well below its 50 DMA and cracking its 200 DMA in the tumble from the recent top of 3.80.

HG Copper: Copper closed the week at 3.5330, well below its 50 DMA and cracking its 200 DMA in the tumble from the recent top of 3.80.

The price action in vopper is a grim reminder of the surprise and ruthlessness with which a C wave decimates price. Copper’s next logical target is 3.40 followed by a deeper target at 3.10.

In the case of copper 3.10 could hold. Keep in mind that bulls will be squeezed with margin calls across all markets simultaneously before this correction is over.

WTI Crude: Crude closed the week at $93.10, just a notch under its 50 DMA but well above its 200 DMA, which is in the $90 area.

WTI Crude: Crude closed the week at $93.10, just a notch under its 50 DMA but well above its 200 DMA, which is in the $90 area.

Crude has important support at $90 followed by a deeper at $84. Crude may well correct in line with all commodities. However, the charts don’t show the sort of structural weakness that metal like gold and silver reveal. My sense is that a any deep correction in Crude prices could be transitory.

$90 is almost certainly on the cards. We may well see $84 before the correction is over.

Shanghai Composite: Shanghai closed the week at 2314.16, a wee bit above its 50 and 200 DMAs. That should be no source of comfort however.

Shanghai Composite: Shanghai closed the week at 2314.16, a wee bit above its 50 and 200 DMAs. That should be no source of comfort however.

Shanghai could take temporary support at its 200 DMA, which is in the 2238 area. However, the safe and logical thing to assume here is that the correction now underway, baring pullbacks will test 100 pc of the rise from 1948 to 2445.

Two reasons: Firstly, I think the rally we just saw was a bear rally that set up a bullish flag. Secondly, Chinese markets tend to rigorously test extremes multiple times. There is time enough on the charts for a retest in the 1950 area.

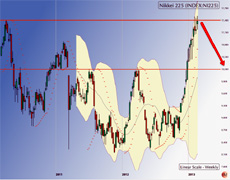

NIKKEI 225: Nikkei closed the week at 11,385.94 after making a double top at 11,506.

NIKKEI 225: Nikkei closed the week at 11,385.94 after making a double top at 11,506.

First support for Nikkei lies at 10,947 followed by a deeper support at 10,200. Nikkei’s 200 DMA lies way down at 9200. So while Nikkei is not bearish in the long-term, expect a fairly sharp, deep correction.

The steep run up in Nikkei shows 9200 could well be tested albeit briefly knocking out traders but leaving investors merely discomfited.

S&P 500 [SPX]: SPX closed the week at 1515.60. It has a day to try and regain 1535 but my sense is that it will miss the mark by a whisker. Even a new high from here is largely symbolic.

S&P 500 [SPX]: SPX closed the week at 1515.60. It has a day to try and regain 1535 but my sense is that it will miss the mark by a whisker. Even a new high from here is largely symbolic.

The intriguing question is the shape and depth of the ensuing correction. Safe to say markets will be sideways for a while and keep hopes of a new high alive.

However, SPX universe is not a monolith and there could be considerable churn in terms of sectors. The techs for instance are not fully in sync with SPX movements.

Traders should look for confirmation to play the short side. Investors should take out all the garbage in the midcap space if not already done. The Russell 2000 space has the maximum froth suggestive of distribution.

NSE NIFTY: NIFTY closed the week at 5850, which has been an important support for the market since December 2012.

NSE NIFTY: NIFTY closed the week at 5850, which has been an important support for the market since December 2012.

A pullback from 5850 to the 50 DMA at 5970 over the next week can’t be ruled out especially if SPX makes a credible pullback to 1535. Barring such reactive pullback, NIFTY appears headed for the 5700 area indicated earlier as the target for this correction.

Within the NIFTY, there are considerable divergences. Stocks in the FMCG sector like ITC [8 pc of NIFTY] have barely begun their corrections while some like SAIL or Hindalco in the metals sector are pretty much close to their long-term correction bottoms.

Investors should use the correction to buy in looking to individual stocks and not the indices, which are more sentiment indicators rather than that of value. Not saying the indices are not relevant; only that they are at times misleading because of major divergences within the index.

Avoid the midcap space and stick to value among front line blue chips. There are great bargains in that space. I like steel, cement, telecoms, select large PSU banks and engineering giants like BHEL.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

Sonali Ranade is a trader in the international markets