| « Back to article | Print this article |

Could the gains in terms of widening the tax net, increased digital transactions and detection of higher fake currency notes have been achieved without the huge disruption and output loss that demonetisation caused to the Indian economy, asks A K Bhattacharya.

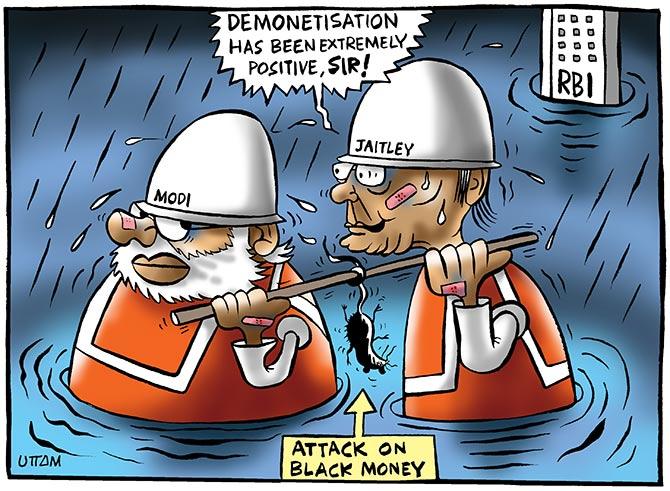

Illustration: Uttam Ghosh/Rediff.com

The Reserve Bank of India (RBI) has ended the suspense over the value of demonetised notes that were returned to it.

Of the Rs 15.44 lakh crore worth demonetised high-denomination currency notes (Rs 500 and Rs 1,000) in circulation as on November 8, 2016, an estimated Rs 15.28 lakh crore have been deposited back with the RBI.

This leaves only Rs 16,000 crore or a little over one per cent of the demonetised notes that have not surfaced so far.

Three questions arise from this revelation and the associated numbers that the RBI made public in its annual report recently.

One, what led to the government grossly overestimating the value of the demonetised currency notes that it thought would not come back to the central bank?

Why was the Supreme Court told that almost Rs 4-5 lakh crore of the demonetised currency notes would not surface? That view was endorsed also by a senior finance ministry official then.

Of course, the finance ministry has now explained that the figure put out before the apex court represented an opinion.

Even if that were an opinion, which indeed it was, there are reasons to believe that the government must immediately examine why and how that estimate was made, prompting its chief law officer to present that view before the apex court.

As early as the first week of December 2016, the RBI had some information that returns of demonetised notes were taking place in huge numbers.

On December 10, it had estimated that over 80 per cent of the demonetised notes were already back with the banking system.

Just about three weeks were left by which the demonetised notes could have been returned.

Shouldn’t the government and the central bank have got a sense by then that the estimate of how many high-denomination currency notes would be returned could go wrong?

It is also true that, as the finance minister has argued, the government today is in a better position to identify illicit money from what was returned to the banking system.

After the return of the demonetised notes, the government has now assessed that an estimated Rs 1.7 lakh crore of deposits could be termed “suspicious”.

Already, Rs 29,200 crore of this has been admitted by the depositors as undisclosed income and more than five million new income-tax returns were also filed this year.

Other numbers that have been revealed in the RBI annual report are worth a closer look.

The currency in circulation as per cent of gross domestic product (GDP) has declined. It used to be 12 per cent of GDP before demonetisation and it was down to about 10 per cent by the end of August 2017.

Total card transactions, including credit cards, debit cards and prepaid instruments, saw a 68 per cent increase at Rs 7.4 lakh crore in 2016-17, compared to Rs 4.4 lakh crore in the previous year.

The increase in such transactions in 2015-16 was only 33 per cent.

The detection of fake currency notes could also be attributed to the demonetisation drive, if one goes by the RBI annual report.

The value of detected fake Indian currency notes went up to Rs 43.5 crore in 2016-17, compared to Rs 29.6 crore in the previous year. The value of fake currency notes detected in 2014-15 was lower at Rs 28.7 crore.

But the question that begs to be answered is whether all these gains in terms of widening the tax net, increased digital transactions and detection of higher fake currency notes could have been achieved without the huge disruption and output loss that demonetisation caused to the Indian economy.

Was a more sustained and steady campaign better than the shock of demonetisation to achieve all these goals? Now that all the data are becoming available, a more reasoned study on the futility of demonetisation is called for.

Finally, the central bank must explain why it took so long for it to come out with the total number of the demonetised currency notes that were returned to it.

Remember that it was a long wait and even now this figure is only an estimate, subject to further correction.

The central bank governor was quizzed by parliamentarians to reveal the number of notes returned to it a few months after the last date for submitting the demonetised notes was over.

But the governor maintained that the exercise to verify the returned notes was going on and he would reveal the numbers only when the central bank was sure.

Did it take so long because the central bank wanted to recheck all the numbers because of a fear that the value of the returned demonetised notes could have exceeded even the estimated currency in circulation at the time of demonetisation?

The nation, for the present, must be relieved that such a fear was unfounded.