| « Back to article | Print this article |

Total net debt-equity ratio improves for third consecutive year, while investment in new projects hits a 10-year low, says Krishna Kant.

Illustration: Uttam Ghosh/Rediff.com

For the third year in a row last fiscal year, corporate India stayed focused on deleveraging its balance sheet and not pushing for growth, in spite of the recent pick-up in revenue growth.

Corporate India’s net debt-equity ratio improved for the third consecutive year in FY18 while investments in new projects hit a 10-year low.

Combined fixed assets or investments in plant and equipment, including projects under implementation of companies (excluding those from the oil and gas sector), was up three per cent in FY18, growing at the slowest pace in at least 10 years.

The result was a virtual freeze in borrowings by the corporate sector.

Companies’ combined gross debt was up 3.3 per cent year-on-year (YoY) last fiscal year, growing at the slowest pace in at least a decade (see charts).

In comparison, the combined revenue of this set of companies was up 10.5 per cent YoY last fiscal year, while their net profits were up 3.4 per cent.

Net worth or shareholders’ equity was up 9.7 per cent last fiscal year due to a combination of higher profitability and fresh capital-raising by many companies.

The freeze on new investment is even steeper in the manufacturing and infrastructure sectors.

The combined fixed assets of companies - excluding oil and gas, information technology (IT) services and fast moving consumer goods (FMCG) - grew 2.8 per cent last fiscal, the slowest in at least a decade.

The net result was an improvement in balance sheet leverage, which is positive for bankers and the stock market valuation for many of the debt-laden companies.

Companies’ (ex-energy) net debt as a proportion of their net worth or shareholders’ equity improved to 60 per cent on average in FY18, from a decade high of 68 per cent in FY16.

In the same period, the leverage ratio for companies excluding oil and gas, IT services and FMCG improved to 80 per cent from a 10-year high of 87 per cent in FY16.

Profitability in the oil and gas sector is driven by a mix of external factors and government regulations, while IT companies and FMCG companies have historically been debt-free and sit on large amounts of free cash.

This skews the balance sheet ratios for rest of corporate India.

Analysts, however, caution from reading too much into headline ratios.

“Most of the decline in debt-to-equity ratio is either due to higher profitability in consumer sectors or the financial restructuring of corporate debt under the Insolvency and Bankruptcy Code (IBC), which forced banks to take a large haircut on their exposure to these companies,” says G Chokkalingam, founder and MD of Equinomics Research & Advisory Services.

Under the IBC, corporate debt became losses for banks and it shows in decline in total corporate debt.

At the end of March this year, the total debt of corporate India was worth Rs 26.9 trillion, up from Rs 25.7 trillion a year ago.

Against this, companies had cash and equivalent worth Rs 8.66 trillion at the end of March, marginally down from Rs 8.73 trillion a year ago.

Excluding oil and gas companies, the gross corporate debt increased to Rs 22 trillion at the end of March this year, from Rs 21.3 trillion a year ago, while companies’ cash reserves increased to Rs 7.48 trillion from Rs 7.42 trillion a year ago.

The analysis is based on the annual audited balance sheets of 911 companies that are part of the BSE500, BSE Mid-cap and BSE Small-cap indices.

The sample excludes banks and non-bank lenders, and aggregate data has been adjusted for listed subsidiaries of listed holding companies to avoid double-counting.

Deleveraging of corporate balance sheets is, however, progressing slowly and has not been a smooth affair.

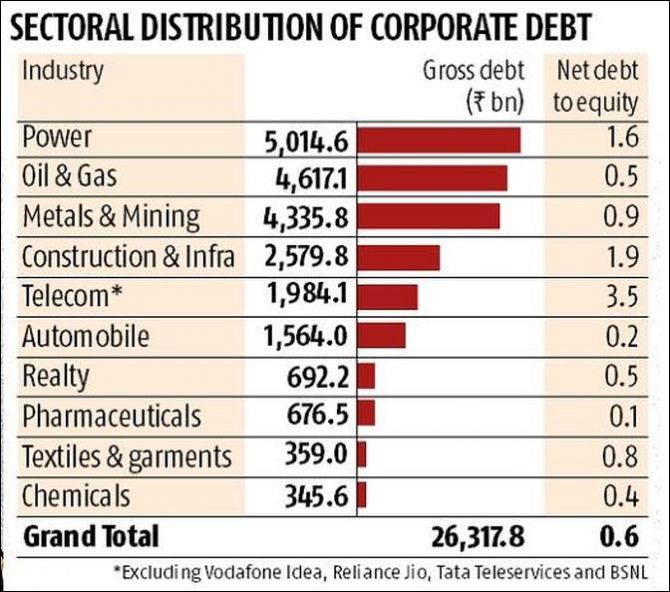

While companies in majority of the sectors reported an improvement in their leverage ratio last fiscal year, net debt-to-equity ratio worsened in metals and mining, power, and telecom sectors in the last fiscal.

This could be a cause of worry given these three sectors accounted for 43 per cent of corporate India’s all outstanding debt in FY18, on average.

Another worry for lenders is the continued polarisation of corporate profitability.

Corporate profits and liabilities (debt) continue to lie in different buckets - the firms or sectors that are most indebted are not the most profitable ones, making it tough for banks to get back their money.

For example, power companies together account for nearly a fifth of all corporate borrowings but the sector has only 5.9 per cent share in overall corporate profits.

The four most debt-heavy sectors - power, metals and mining, construction and infrastructure, and telecom accounted for 53 per cent of all borrowings but only 12 per cent of corporate profits in FY18.

Among the big borrowers, oil and gas, auto, and pharmaceutical are the only industries where debt and profits seem to go together.

Analysts put a caveat on the future trend in corporate debt, saying the deleveraging process also faces risks from a potential decline in profitability due to the recent rise in crude oil and metal prices, besides higher interest rates.

According to him, part of the blame lies with the Centre for failing to adequately recapitalise public sector banks (PSBs), the primary lenders to corporates, leading to a virtual freeze in fresh lending.

“The banking system works through a multiplier effect. A freeze in corporate lending creates liquidity and payment issues for businesses leading to even more bad assets for banks,” Dhananjay Sinha, head of research, Emkay Global.

For the first time in over two decades, PSBs didn’t make any fresh loans on a net basis, in FY17 and FY18.

In other words, loan repayments exceeded fresh borrowings for PSBs as whole, leading to a credit squeeze for corporate.