The Undisclosed Foreign Income and Assets (Imposition of Tax) Act, 2015, approved by Parliament this week, empowers the Union government to enter into agreements with other countries for the exchange of information, recovery of tax and avoidance of double taxation.

In the first of a three-part series Paranjoy Guha Thakurta details the salient features of the new law.

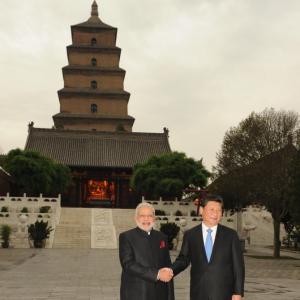

Prime Minister Narendra Modi has been, and continues to be, ridiculed by his opponents because of his government's inability to bring black money back to the country. He had repeatedly promised during his election campaign that money illegally held by Indians abroad would be brought back and distributed among the poor.

A year in power, in order to convey the impression that he still means business, a law has been enacted which seeks to increase penalties on Indian citizens who have concealed foreign income. But the new piece of legislation is unlikely to significantly alter the reality on the ground. It will hardly make a dent on what is undoubtedly a huge problem.

Finance Minister Arun Jaitley claims the new law would go a long way in dissuading Indians from keeping black money in foreign bank accounts.

On Monday, May 11, the Lok Sabha passed the Undisclosed Foreign Income and Assets (Imposition of Tax) Bill, 2015, which is now an act that penalises the concealment of foreign income and provides for criminal liability for attempting to evade tax on the foreign incomes of Indians.

At the beginning of the debate in the Lok Sabha, various members of the opposition urged that the bill be referred to a parliamentary committee for examination since it contained substantial and significant provisions of law that went beyond taxation proposals. Hence, it was argued that the bill needed greater legislative scrutiny than what an ordinary "money bill" would warrant.

The Speaker did not agree with the demand of the Opposition.

Jaitley had first outlined the contours of the new law to deal with undisclosed foreign incomes and assets of Indians while announcing his Budget proposals on February 28.

The enactment of the bill, which was introduced on March 20, became a formality after it was passed by the Lok Sabha. Since it had been deemed a "money bill", the Rajya Sabha (where the government lacks a majority) could do nothing but discuss the law and return it to the Lower House.

Before examining the reasons why the law is unlikely to result in black money returning to India in substantial quantities, a quick overview of the salient aspects of the Undisclosed Foreign Income and Assets (Imposition of Tax) Act, 2015, is called for.

Black money or "black income", which is income on which taxes payable have been evaded, can be classified into two categories: domestic and foreign. The finance minister has clarified that the new law has nothing whatsoever to do with domestic black money (which is much greater than the quantum of foreign black money held by Indians, as we shall note).

The law provides for separate taxation of any undisclosed income from foreign assets and incomes; such income will henceforth not be taxed under the Income Tax Act, 1961. The strict monetary penalty and criminal prosecution proposed under the law has invited both appreciation and criticism.

The law provides for the taxation of undisclosed foreign income and assets at a flat rate of 30 per cent. No exemptions, deductions, set-off or carry-forward of losses under the provisions of the Income Tax Act would be allowed.

Non-disclosure of incomes or assets located out of India will attract a penalty equal to three times the tax payable, that is, 90 per cent of the income or the value of the non-disclosed asset. This would be in addition to the 30 per cent tax payable.

The offence will be made non-compoundable and the offenders will not be permitted to approach the Settlement Commission. In case of non-filing of returns or non-disclosure of income or assets in the return, the penalty provided is Rs 10 lakh (or Rs 1 million).

Second and subsequent offences will be punishable with rigorous imprisonment of between three and 10 years with a fine of up to Rs 1 crore (Rs 10 million).

Undisclosed holdings of less than Rs 500,000

In addition to penalties, the Act also provides for prosecution for tax evasion and non-filing of returns. Wilful evasion of taxes in relation to foreign income or assets is punishable with rigorous imprisonment of between three years and 10 years along with a penalty equal to three times the amount of tax evaded or 90 per cent of the undisclosed income or the value of the asset.

Non-filing of returns with respect to foreign income or assets or bank accounts is punishable with rigorous imprisonment of between six months and seven years.

These provisions will also be applicable to the beneficial owners of these illegal foreign assets. A beneficial owner is the person who is the de facto owner of such income or asset and enjoys the benefits derived out of it.

Interestingly, the law also makes inducement or abetment of another person to file a false return or make a false statement or declaration under the Act a punishable offence. Such a provision had hitherto been absent in the country's laws dealing with tax evasion or money laundering.

Theoretically, this provision in the law can hold banks, chartered accountants, legal advisors and financial institutions liable, together with the holders of black money.

The tax authorities will have powers of discovery and inspection, issue of summons, enforcement of attendance, production of evidence and impounding of account books and documents.

The law also provides for a one-time limited compliance window for a short period for offenders to come clean about their foreign assets and income by paying 30 per cent tax and a "concessional" penalty of the same amount, thereby avoiding having to face prosecution.

The finance minister clarified this provision in Parliament: "If you make a disclosure during this window, you will pay 30 per cent tax and 30 per cent penalty. Once the compliance window closes, the law becomes further operative as you will have to pay 30 per cent tax and 90 per cent penalty and face prosecution and imprisonment up to 10 years…"

Jaitley further stated that the "window" in the Act is "not an amnesty scheme", adding that the identities of the persons disclosing information would not be protected.

On the issue of disclosure of identities of persons of Indian origin with money and assets abroad, he mentioned that Germany and the United Kingdom had sought clarifications as to why the names of persons given to government authorities here in "confidence" had found place in Indian newspapers.

The compliance window will not be offered to non-resident Indians or professionals working abroad -- it is only being provided to Indian residents who are income tax assessees and have spent more than 182 days in a year in India.

Under this voluntary disclosure of income scheme of sorts for Indians holding black money outside the country, no wealth tax will be levied on the declared income and no prosecution will be based on the declared income of those who avail of this one-time opportunity.

The new act also proposes amendments to the Prevention of Money Laundering Act, 2002. It seeks to make the offence of concealment of income or evasion of tax in relation to a foreign asset a predicate offence under the PMLA.

This provision would enable enforcement agencies to attach and confiscate unaccounted assets held abroad and launch prosecution proceedings against persons indulging in laundering of black money.

The Act empowers the Union government to enter into agreements with other countries for the exchange of information, recovery of tax and avoidance of double taxation.

The right to appeal will be to the Income Tax Appellate Tribunal and to jurisdictional high courts and the Supreme Court on substantial questions of law.

Research assistance: Shinzani Jain

Next in the series: Why new law may not be able to bring back money illegally stashed by Indians in foreign banks.