| « Back to article | Print this article |

The government should now focus on governance and monitoring the supply side to manage inflation, says M V Subramanian.

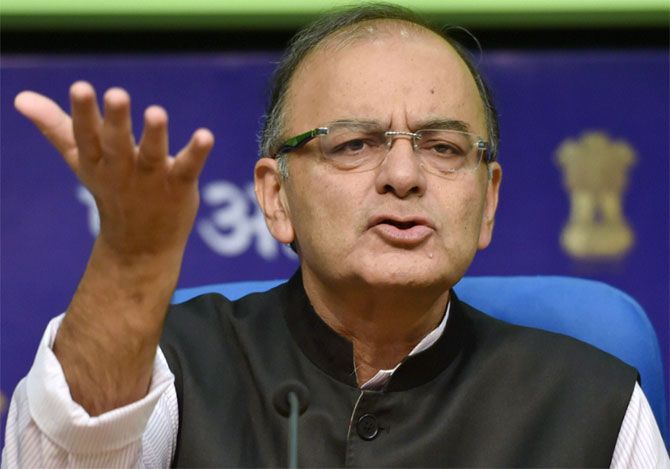

Though expectations from Finance Minister Arun Jaitley were very high as far as drawing investment and raising of resources for all the pet projects of the new government were concerned, the Budget announced by the FM on Saturday corroborated the thinking of his government and its intention to provide relief to all sections of the nation.

Realism has set in while governing the country for the past 10 months and now they realised very well the real meaning of governance, despite getting a huge mandate in the general elections.

The higher devolvement of resources (32 per cent to 42 per cent) to the state governments, after accepting the latest Finance Commission recommendations, has been commendable and against this backdrop the government has agreed to adhere to fiscal discipline albeit with a delayed one-year time-frame.

Some commentators are saying that the FM had given a clear road map for the next four years, but in my view most of the statements are forward in nature as in the past Budget proposals. Just because he had said that he would bring down the maximum corporate tax rate from 30 per cent to 25 per cent in the next four years (beginning next year), where is the clarity as to when exactly will the tax rate come down and what exemptions/concessions will be withdrawn?

Will it happen only on the fourth year? In fact, in the immediate next financial year, corporates have to pay more tax (including the additional surcharge), more excise duty and more service tax. The FM said he didn’t want to surprise the corporates and was making this announcement to prepare them, but that would be wise only if you are increasing the tax rate, not while reducing. Everyone would love these surprises!

Budget 2015: Complete Coverage

The finance minister had walked the fiscal tightrope, despite the growth in GDP, declining inflation trends and the huge $50 billion benefit from the oil price decline. The revision in the GDP methodology and the numbers which they are quoting are unrealistic; though intellectually prepared, it doesn’t give credence to reality. The FM went to the extent of announcing that double-digit GDP growth during 2016-17 is a possibility and I can bet that this is a dream as the entire emerging markets' average growth is likely to be six per cent per year for the next two years and India historically had not done more than two per cent over the average EM growth for the past 20 years.

Some of the social initiatives for the poor and SC/STs announced in the Budget are noteworthy. The one rupee per month medical insurance, less than one rupee per day life insurance and the Atal Pension Scheme are valuable and timely for the poor, but those plans should not go the way of PM's Jan Dhan Yojana scheme, where over 90 per cent of the accounts have zero balance and are non-operative.

Recently the Payment Corporation of India, which had provided the Rupee Cards, announced that the poor who had not swiped the card so far are not eligible for the insurance cover announced in the scheme, whereas the poor who opened the accounts thought they are going to get Rs 100,000!

A definite time to commence the GST from April 1, 2016, is a conclusive decision of the government which is a game changer for indirect tax computation and collection. There is, however, very little clarity on the agreement signed by the Reserve Bank of India on inflation and monetary policy directions.

The FM had pleasantly increased the medical insurance exemptions for all types of individuals, which is timely, but the limits are still low when compared to the medical insurance premia being paid to cover various types of illness.

Three new initiatives to monetise and lure gold investors to bonds instead of investing in idle gold investments are really useful and the products should be sold effectively, with a good incentive to the organisations which are supposed to sell; otherwise, these products will not get the right importance as has happened in the case of NPS (New Pension Scheme).

At the same time, the option to be given to employees under the EPF (Employees' Provident Fund) scheme is contrary to the above objective. The government’s logic of more money in the hands of the employees will deny the security the families enjoy now. Every employee, unless made compulsory, would be happy to take as much as take-home pay and never bother about future needs. They will even ask the employers’ contribution to be paid to them directly each month.

.jpg?w=670&h=900)

The investment decisions announced by the FM for the power sector, micro and small enterprises, agriculture, roads, railways, PSUs, defence and other infrastructure projects are notable and this public investment is a must to push the economy as private investments have not been kick-started.

The environment for new investment in the private sector is not there as of now, though the sentiment has changed after the Modi government came to power. Banks are not seeing growth in their loan books (for large, MSME and small businesses) and the only significant growth seen by them is in the housing sector.

Interest rates are still high and banks are finding it difficult to pass on (not transmitting) the benefits they get from the RBI’s monetary measures over the past 12 months. The return of the infrastructure tax-free bonds for road, rail and irrigation projects is a welcome step and Jaitley has learnt the lesson from his predecessor P Chidambaram. It is a win-win situation for raising resources for infrastructure purposes.

Budget 2015: Complete Coverage

The addition of NBFCs at par with the banks under the Sarfaesi Act is a welcome step and this is a long-standing request from the non-banking finance corporations. I don’t understand the need for a new Bankruptcy Act to be passed by Parliament. Instead of a new law, judicial reforms are required to speed up the legal process for recoveries.

Similar is the case with new laws to spot black money and to punish the offenders. The focus should be on enforcement of laws instead of enactment of new laws, as the same government is planning to strike down some of the outdated laws in the statute books.

The abolition of wealth tax is a welcome step and to collect the surcharge from the rich is a wise decision. This will widen the tax base, and will be easier to monitor and collect revenues. In a country like ours, this cross-subsidisation will have to continue for some more decades. Though there was a fear that GAAR (General Anti-Avoidance Rules) will be buried, the FM has said that he was deferring it for two years.

Overall this is a good Budget which clearly gives the direction of the government but there are no big bang impact and transformational ideas. The focus should now be on governance and monitoring the supply side to manage inflation. They should nudge the RBI to bring down the rates gradually as also the banks to start transmitting the benefits of the monetary policy initiatives.

Continuous policy decisions and implementation should be the key for the government to attract investments, allow doing business with more ease, providing a competitive environment and pushing the GDP growth to higher levels.

M V Subramanian is a retired banker.